Gradual rate declines, modest price growth and affordability challenges will shape next year's housing market, signaling recovery amid persistent supply and economic pressures.

Federal Reserve Policy

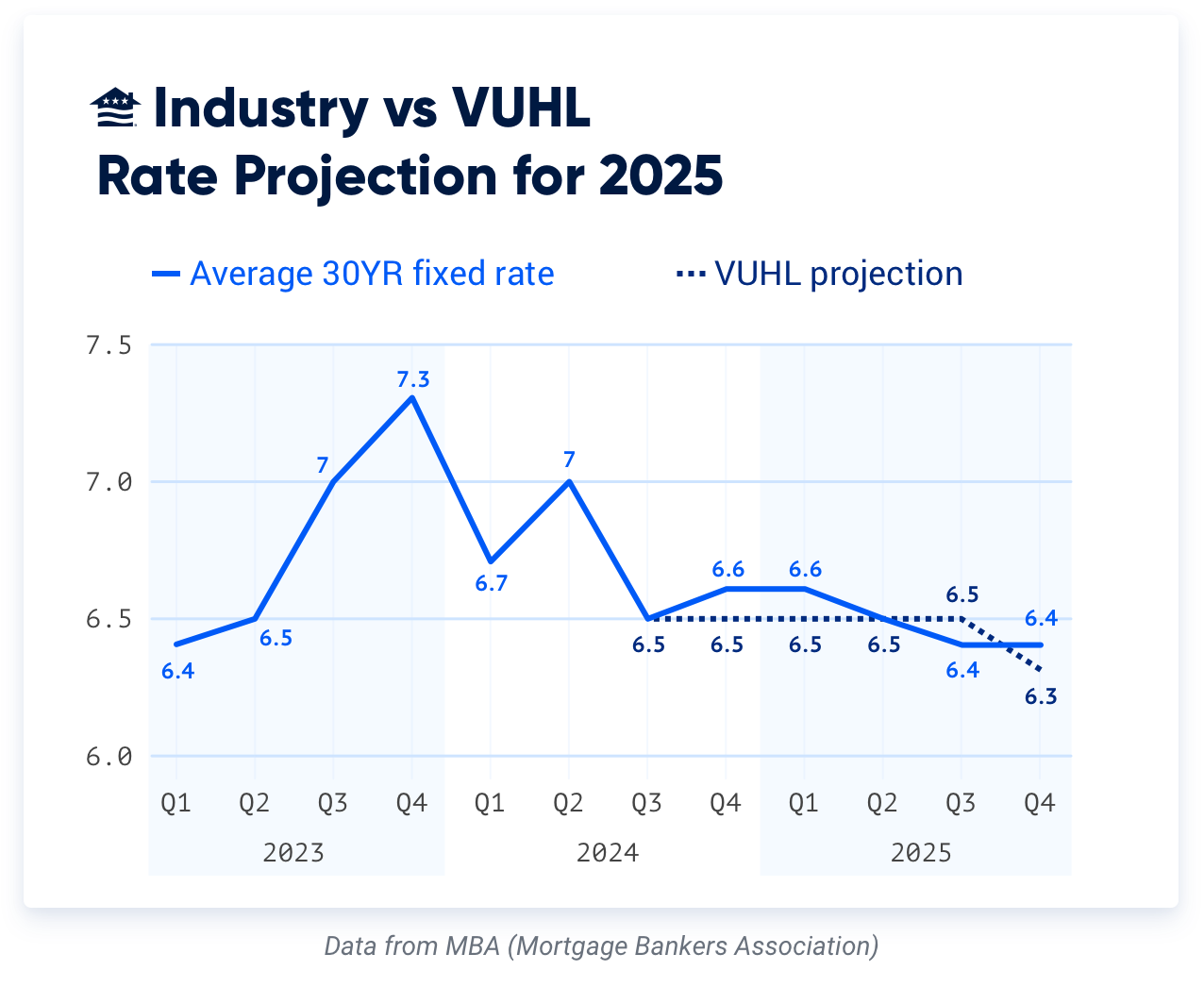

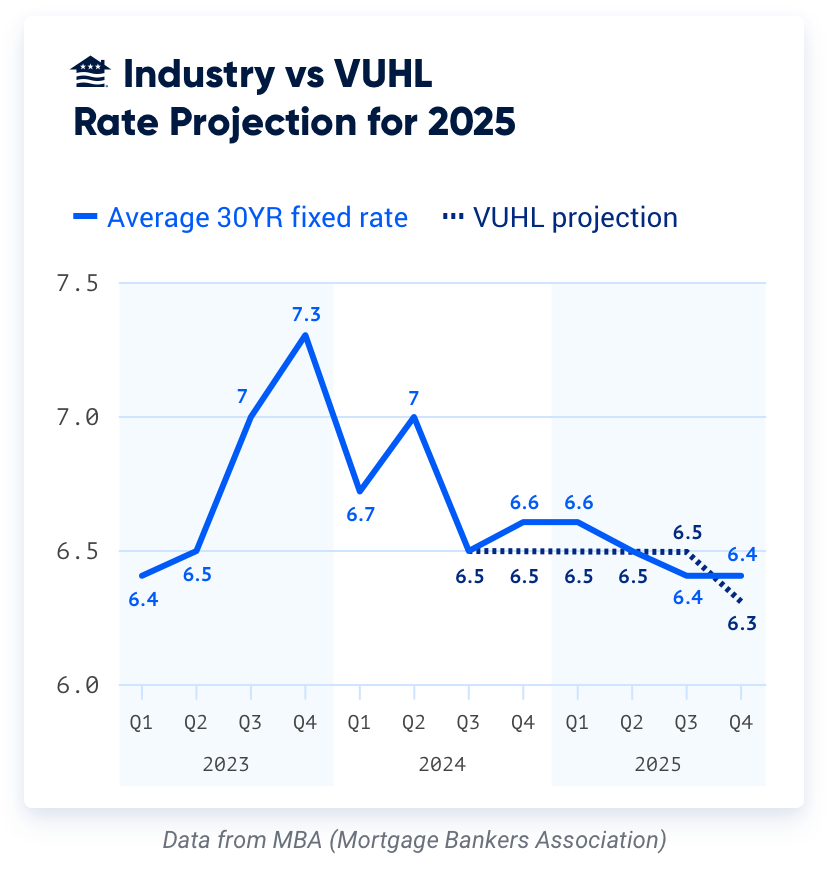

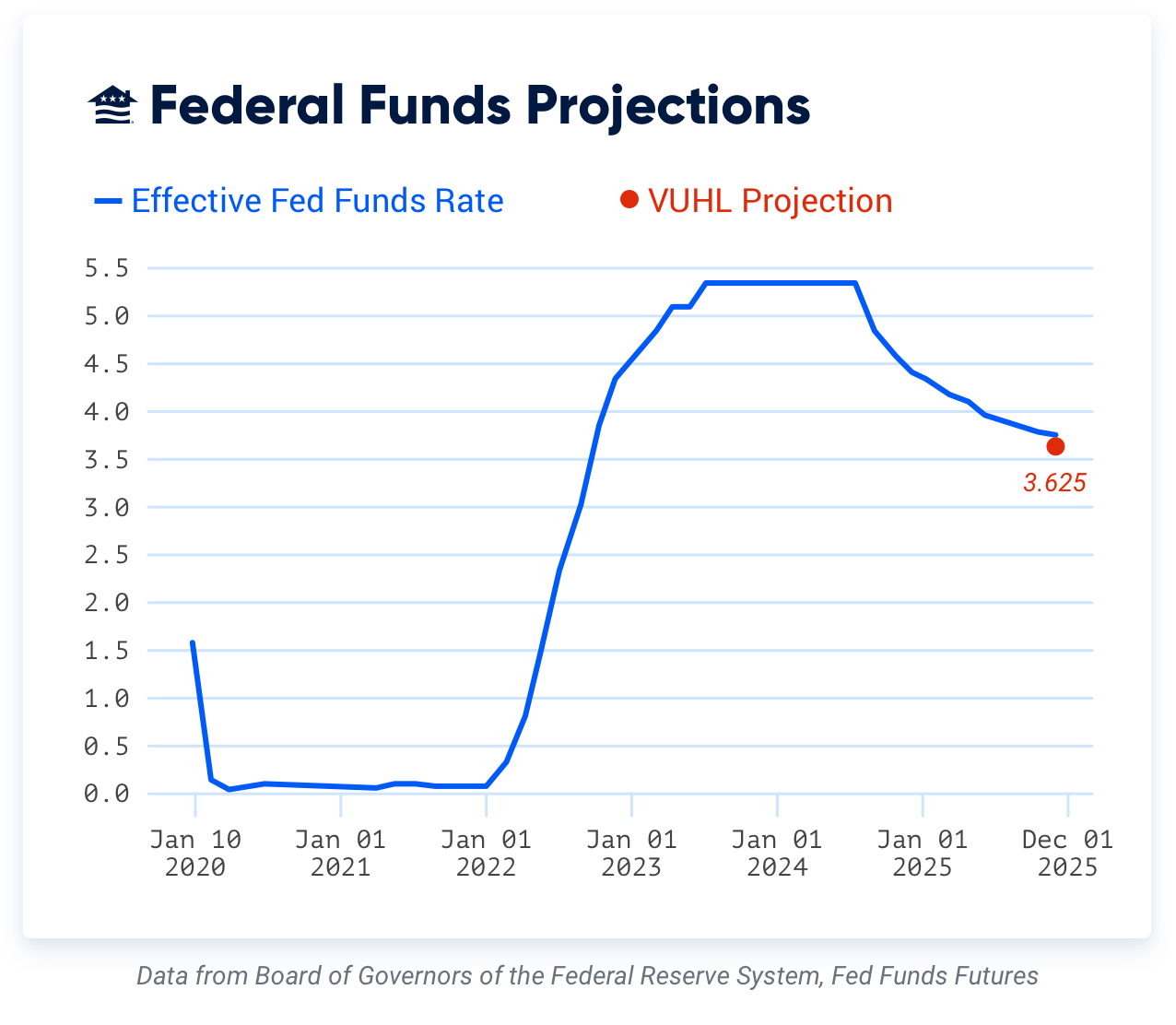

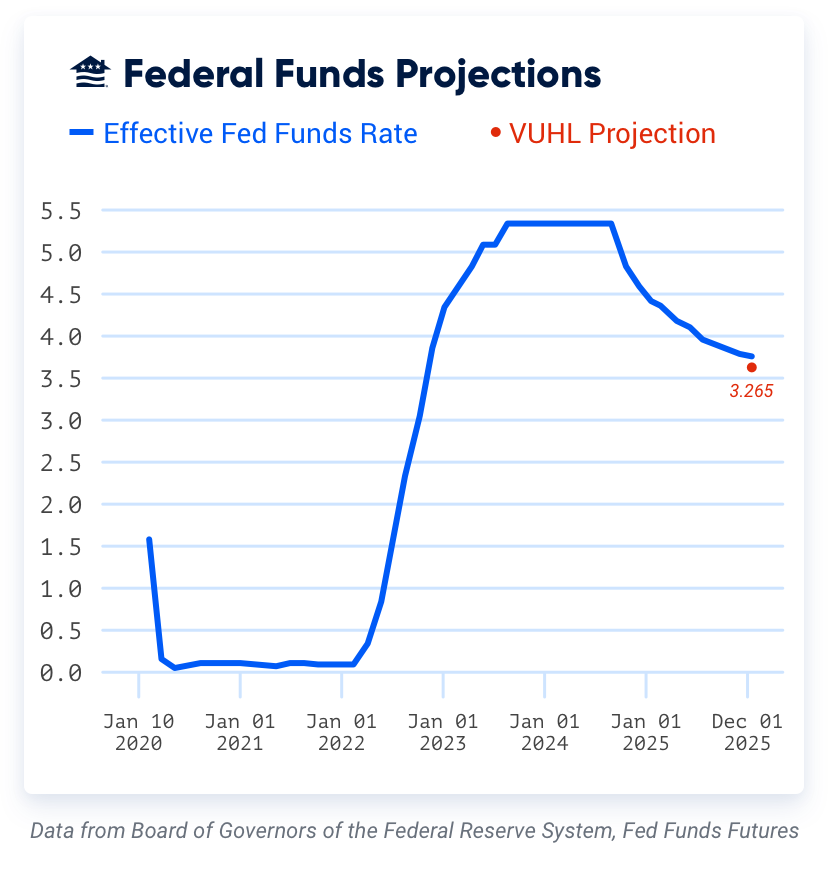

Key Takeaway: The dual mandate of the Federal Reserve policy is to have maximum employment while maintaining stability in market liquidity and inflationary control. With that being said, the Federal Reserve will reduce the federal funds rate by 75 basis points by the end of 2025, leaving us with a new target range of 3.50%-3.75%.

Closer look:

The Federal Reserve’s decision to cut the federal funds rate in 2024 marked a pivotal shift in policy that we expect to continue into 2025 and beyond.

After several years of rate hikes aimed at curbing inflation, the Fed is expected to reduce rates by 75 basis points, ending the year with a target range of 3.50%-3.75%. This policy shift aims to support economic recovery while managing inflationary pressures.

These rate cuts will help ease borrowing costs, but their impact on long-term mortgage rates will be tempered by broader fiscal and global economic factors. Rising Treasury issuance requirements and adjustments in fiscal policy will continue to influence the interest rate environment, creating a complex backdrop for the housing market.

The Fed's gradual approach is intended to avoid destabilizing the market while providing much-needed relief to households facing economic uncertainty.

Housing Affordability

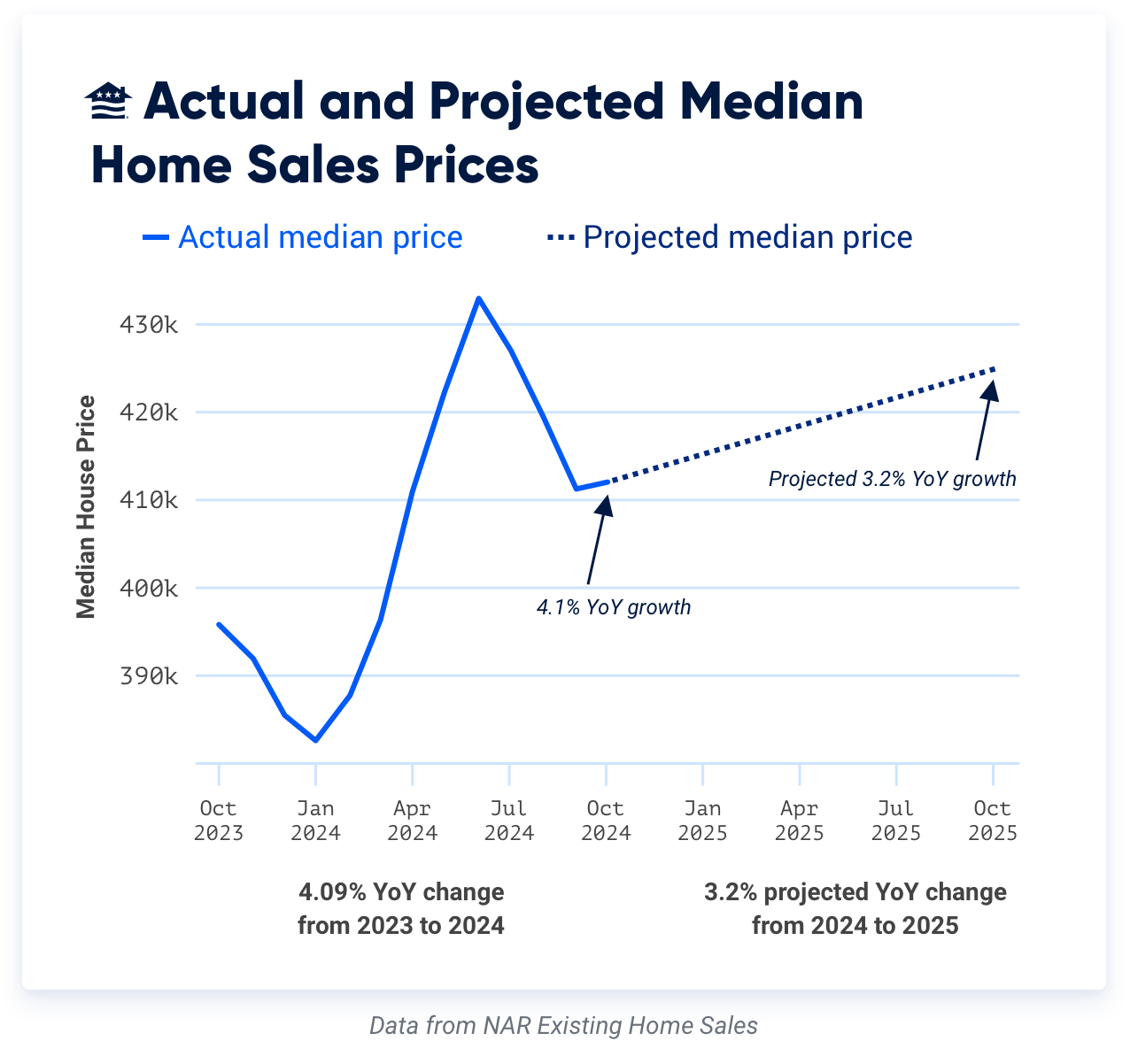

Key Takeaway: Affordability remains a critical challenge as home prices are projected to grow by 3.2%. Buyers will continue to take advantage of seller concessions and creative financing options to navigate the high cost of homeownership.

Closer look:

Affordability will remain a critical issue throughout 2025. Home prices are likely to see more modest growth compared to recent years, which should provide relief to some buyers. But there’s still limited inventory and growing demand in markets across the country.

The expectation is for the median home price to grow 3.2% next year to $424,977 and for existing home sales to end the year between 4.2 million to 4.5 million.

Builders are reducing housing starts in response to anticipated increases in material and labor costs, further constraining the supply of affordable homes. These factors will perpetuate the inventory shortage, particularly in high-demand markets.

Due to the affordability challenge, seller concessions and incentives are likely to continue to play a prominent role in closing transactions. Common incentives, such as rate buydowns and closing cost assistance, may offer some relief to buyers.

For prospective homebuyers navigating affordability challenges in 2025, exploring creative financing solutions will be key. Consider programs designed for moderate-income or first-time buyers to help make homeownership more achievable despite ongoing cost pressures.

Inflation

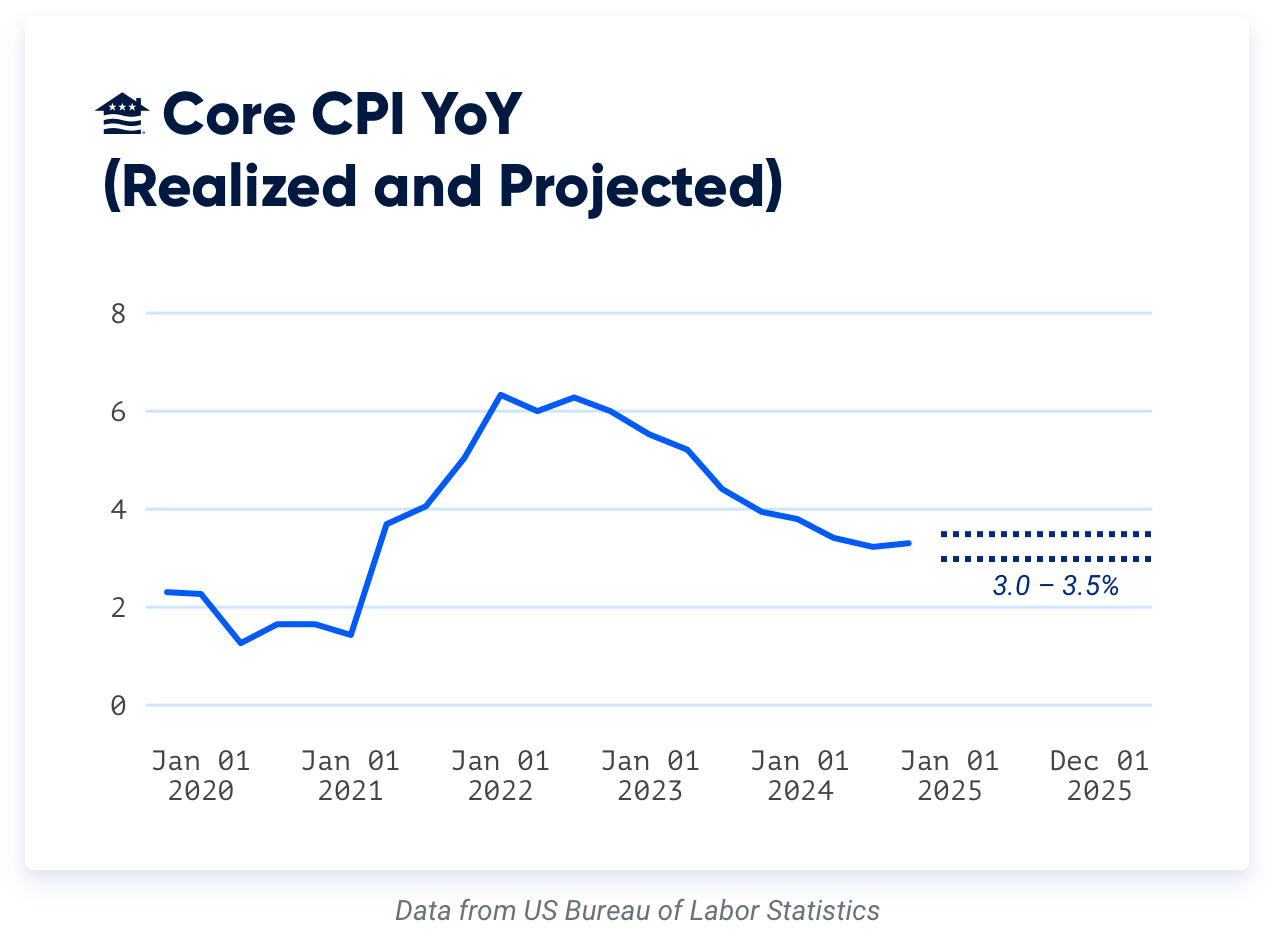

Key Takeaway: Inflation is forecasted to hover between 3-3.5% (core CPI), reflecting persistent price pressures across sectors despite the improvement in 2024.

Closer look:

Inflation is expected to hover in the 3-3.5% range in 2025, reflecting ongoing price pressures across various sectors.

Although this is a decline from previous highs, it remains higher than the Federal Reserve’s objective of 2%, creating a challenging environment for both policymakers and consumers.

As the Federal Reserve continues to drive toward a 2% objective, broader economic stability could improve consumer confidence and foster more active participation in the housing market.

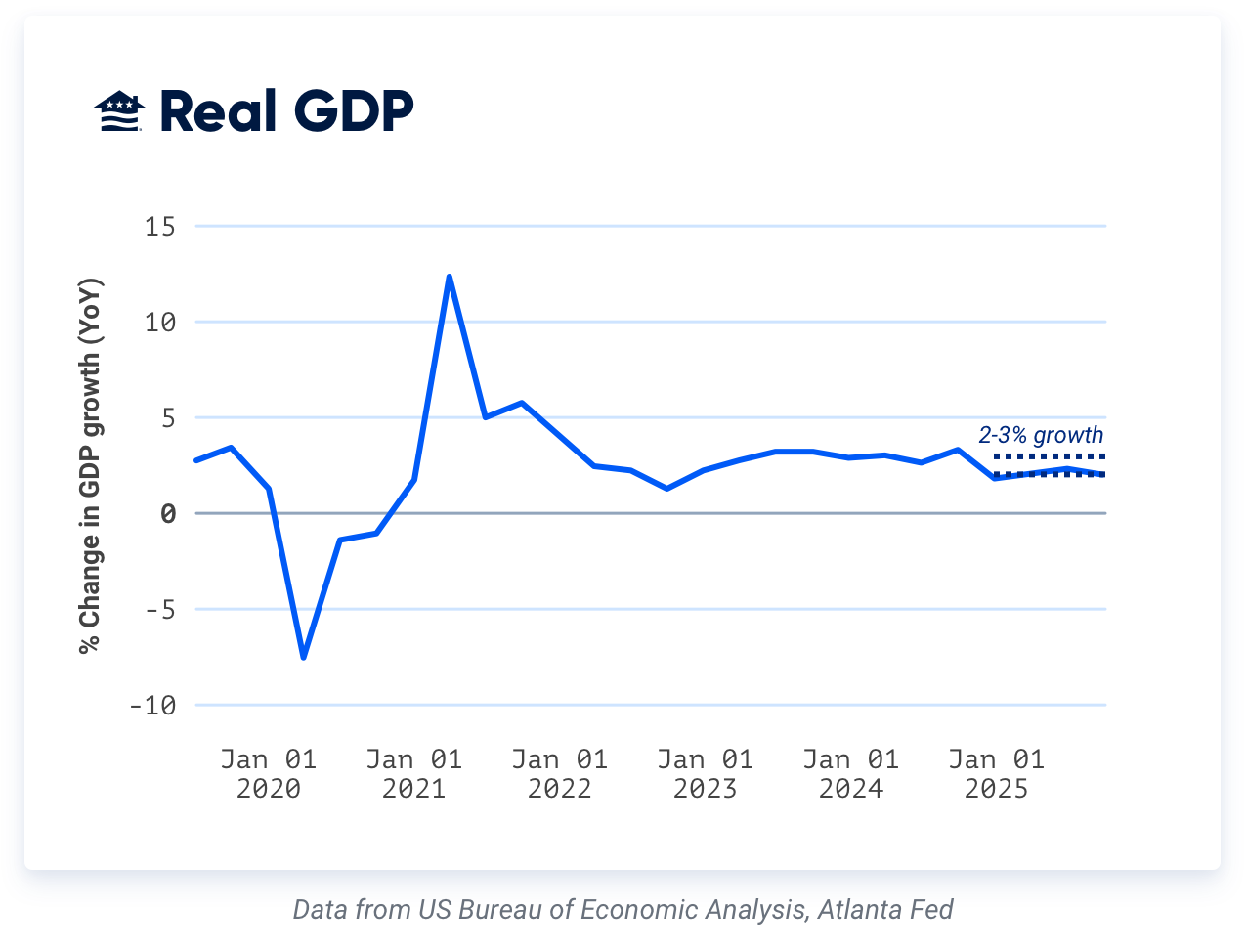

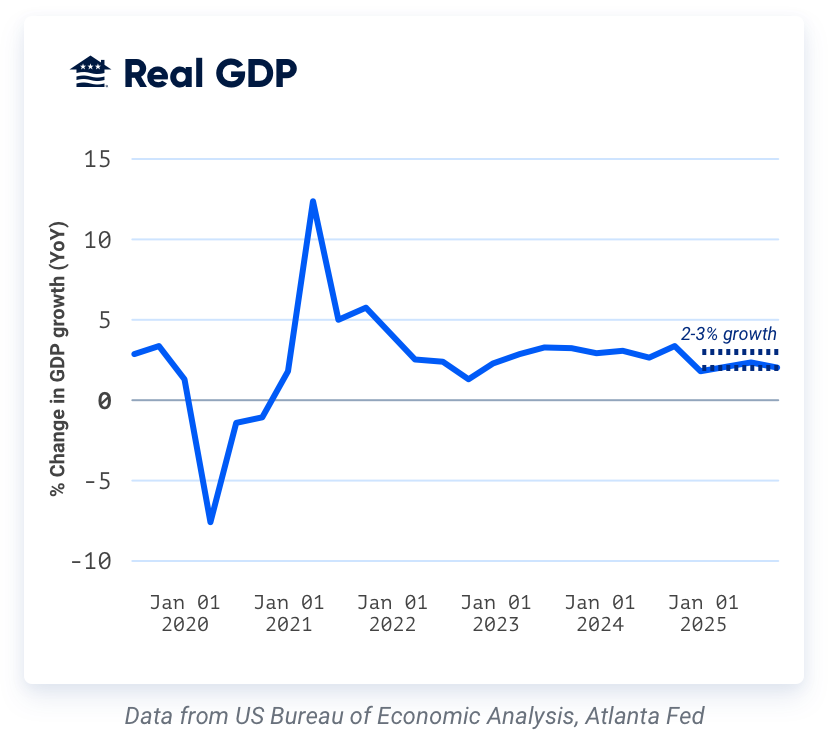

GDP Growth

Key Takeaway: Economic growth is expected to slow with GDP between 2 and 3%. Rising unemployment may dampen consumer spending and reduce corporate investment, which could help stabilize inflation.

Closer look:

The U.S. economy is projected to grow at a slower pace in 2025, with GDP expected to range between 2-3%. This marks a deceleration from the stronger growth rates observed in 2024 and reflects a combination of a moderating labor market and sticky inflation.

The housing market’s contribution to GDP will remain limited by slower growth in housing starts and subdued existing home sales. However, the sector’s long-term potential remains strong, with stable demand and modest price appreciation.

Refinance Outlook

Key Takeaway: Refinance activity is expected to account for 15-20% of the mortgage market, driven primarily by cash-out refinances and home equity products. Additionally, homeowners who have rates above 7%, will have opportunities to lower monthly payments as rates decline.

Closer look:

As the likelihood of a recession subsides, the yield curve will continue to steepen, reducing prepayment risk, which will support refinancing activity and create a more favorable lending environment. These trends are expected to benefit both borrowers and lenders, enhancing market stability and liquidity.

In 2025, the refinancing market is expected to experience nearly the same levels we saw in 2024. Homeowners seeking to tap into equity will dominate this segment, with cash-out refinances and home equity products leading the way.

For borrowers locked into rates above 7%, the gradual decline in mortgage rates presents an opportunity to reduce monthly payments. However, rate-driven refinancing will remain less attractive compared to historical norms, given the relatively high rate environment.

Last Word

Affordability and supply constraints remain central challenges. At the same time, incremental improvements in mortgage rates, Federal Reserve policies, and refinancing opportunities signal progress in the housing market.

The 2025 housing market represents a pivotal moment in the broader recovery, laying the foundation for a more balanced and sustainable future.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.