As the VA loan benefit turns 80 years old, we look back at some of the biggest changes in Veteran homebuying over the last decades.

The VA loan benefit was created to help expand access to homeownership for those who serve our country. Eight decades later, this loan program is still fulfilling its original mission.

VA loan utilization has soared over the last 20 years, with younger Veterans and service members turning to their benefit in waves in recent years. This hard-earned benefit has helped millions of Veterans build wealth and strengthen communities.

The marketplace advantages of VA loans also help to create new opportunities for women, for Veterans of color and for Veterans with disabilities.

Here’s a look at six of the biggest trends in VA lending over the last two decades.

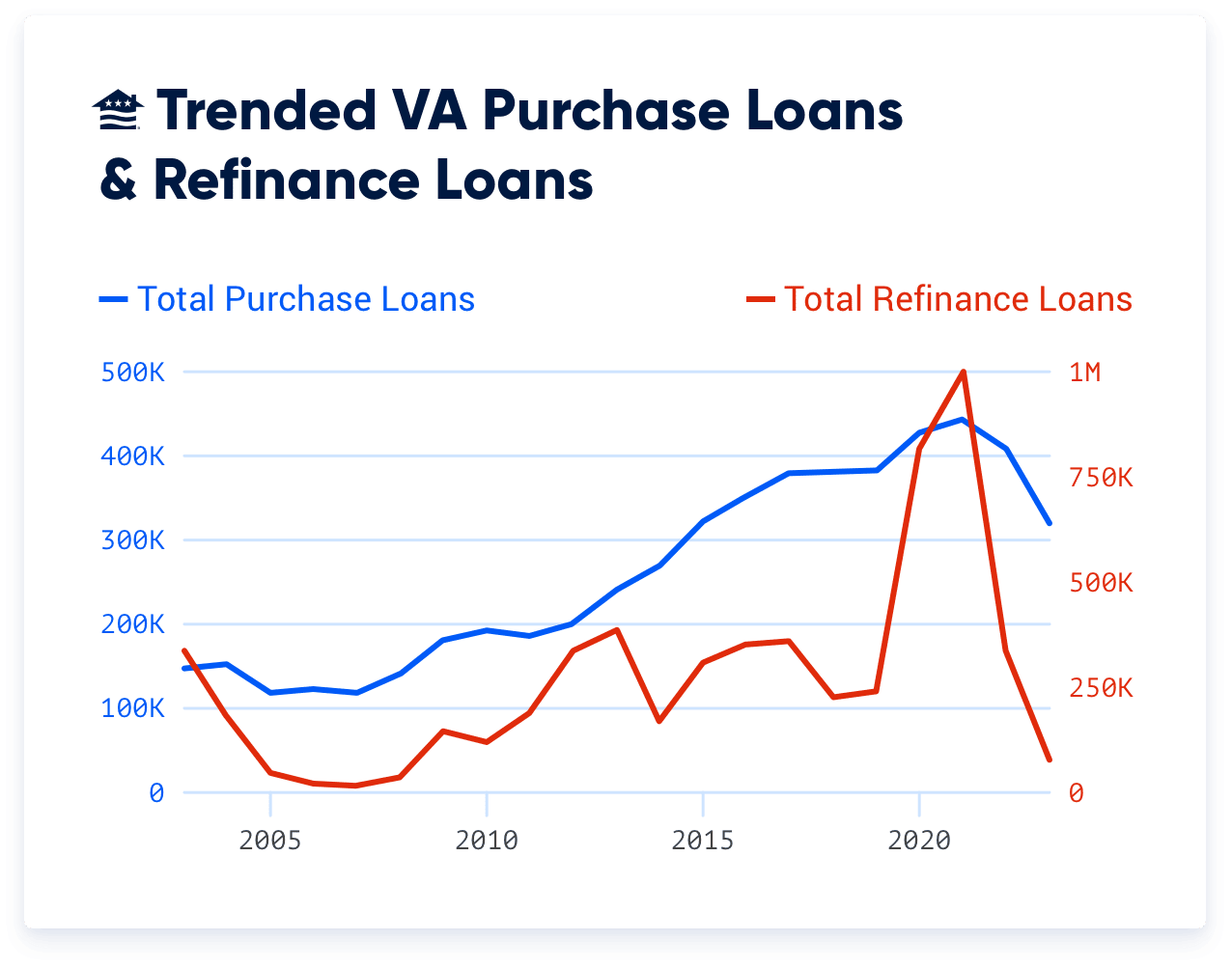

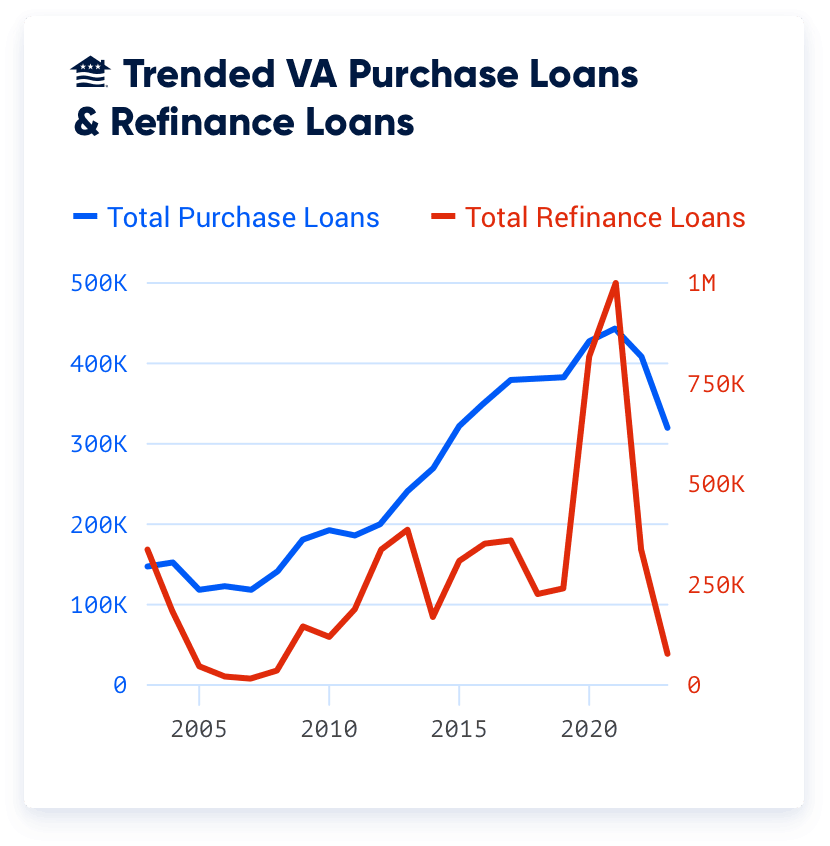

Huge Growth of VA Loans

VA loans lived in the shadows for a long time.

While vital to millions of Veterans and in many ways to the growth of the middle class, the program was a minor player in the mortgage market for most of its existence. But Veterans and service members have turned to their home loan benefit in droves in recent years, especially since the Great Recession.

The VA is close to backing its 30 millionth loan. Nearly 40% of those have come in the last two decades.

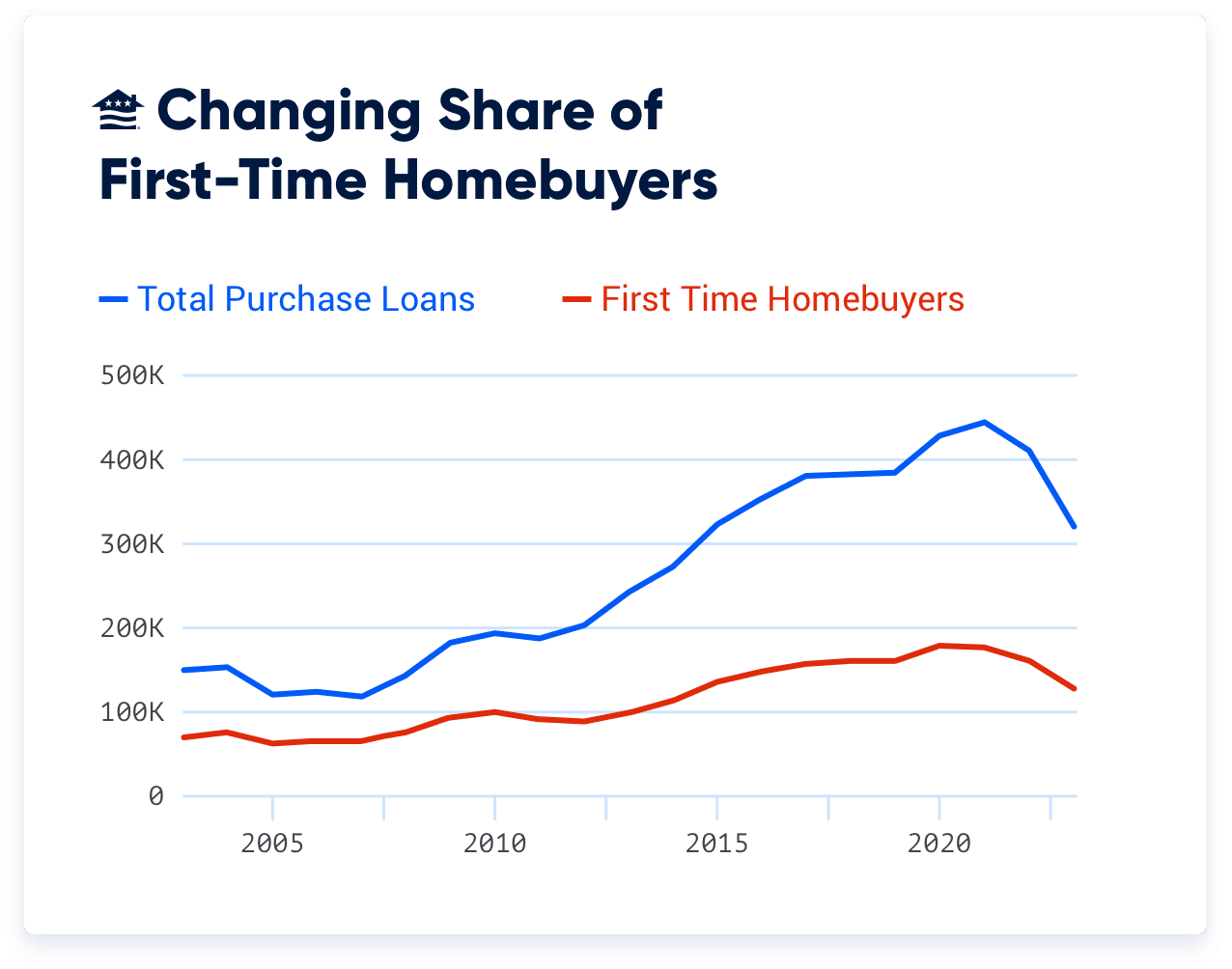

Creating First-Time Buyers

The VA loan’s biggest benefits are especially powerful for first-time homebuyers.

The program was created to reflect the reality that many Veterans sacrificed a chance at building credit and savings in order to serve. That’s a major reason why the 0% down benefit has been there since day one. Beyond that, VA loans don’t require great credit or private mortgage insurance, and they typically feature the lowest average interest rates on the market.

VA loans help Veterans and military families accelerate their homebuying timelines, because they don’t face the same asset-and-credit hurdles so many civilians struggle with.

More than 9-in-10 Veterans (93%) used a VA loan to buy their first home, according to a new Veterans United Home Loans survey conducted to mark the benefit’s anniversary.

Last year alone, Millennial and Generation Z buyers accounted for nearly 60% of VA purchase loans.

Here’s how the share of first-time VA buyers has changed over the last two decades:

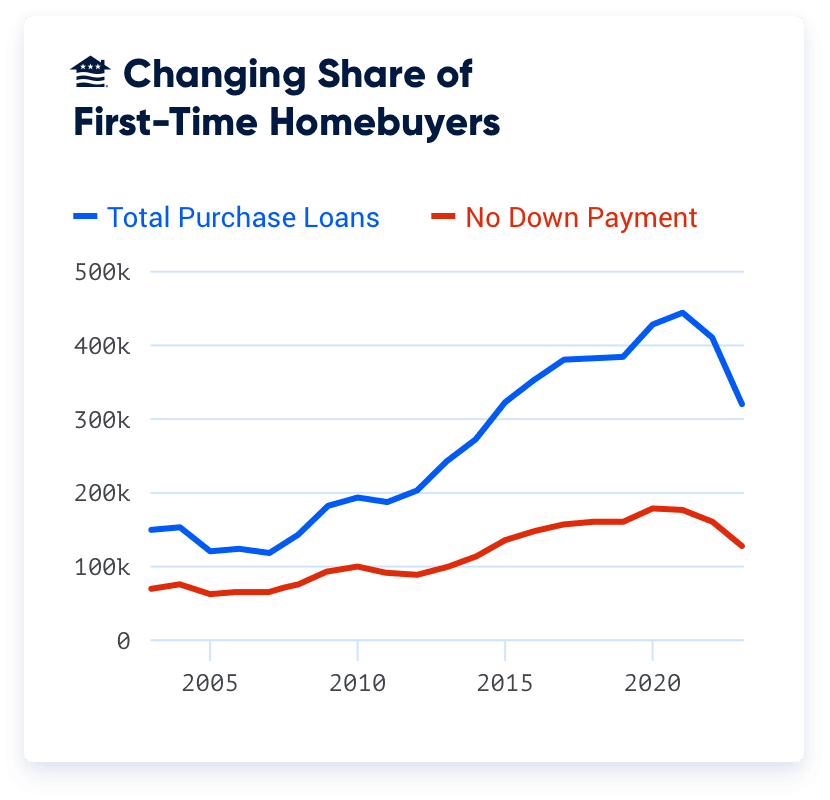

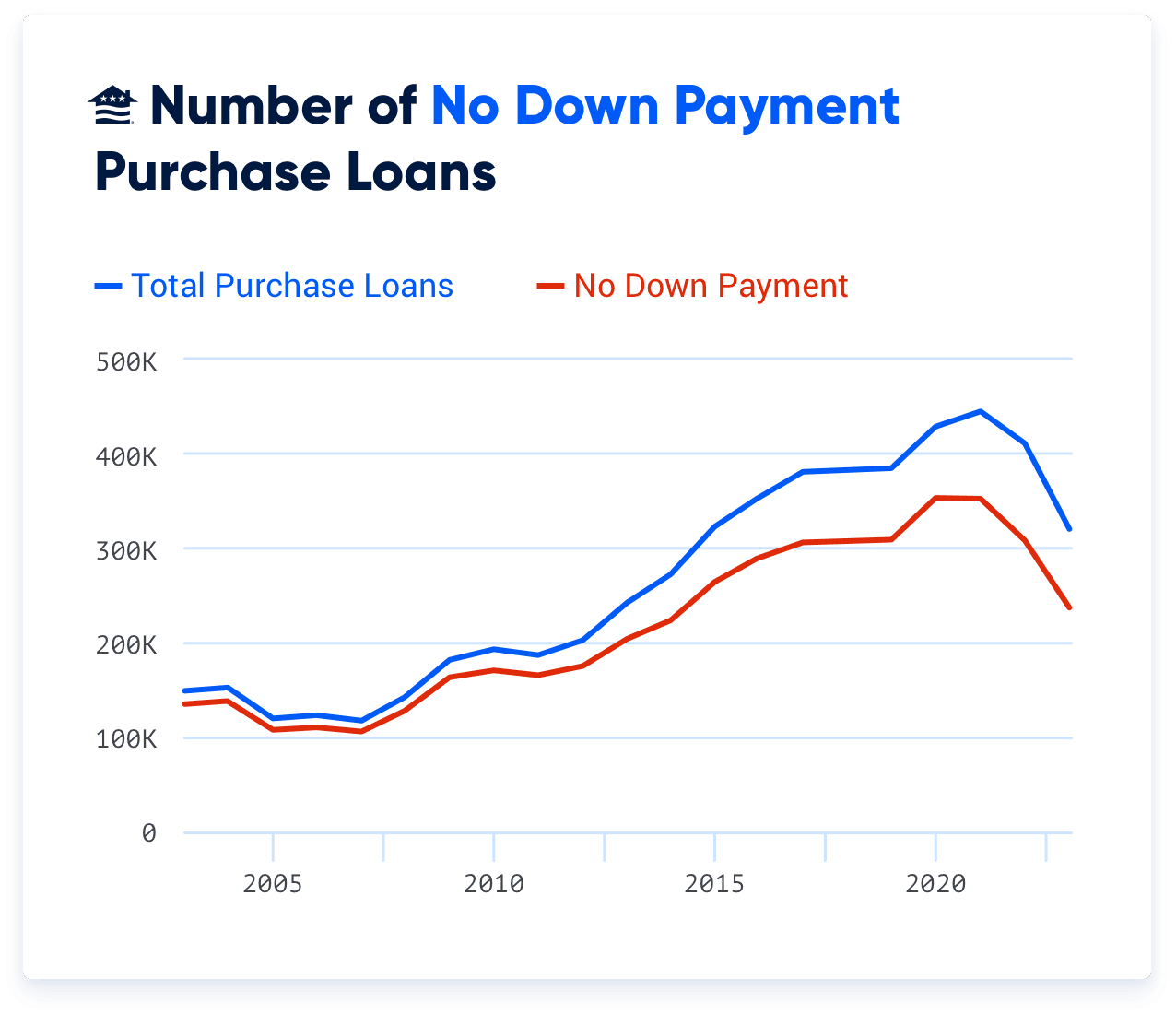

Fewer Buyers Going 0% Down

Since their inception, the signature benefit of VA loans has been the opportunity to buy without a down payment. Most loan products require at least 3% down, but prospective buyers might need significantly more to tap into the best rates and fees.

Saving for a down payment can take years, especially for younger Veterans and service members. Removing this obstacle helps accelerate homebuying timelines and make homeownership more accessible for those who serve.

But fewer VA buyers are going zero-down as home prices and home equity levels have risen over the last two decades.

Back in 2003, a little more than 9-in-10 VA buyers purchased without a down payment. Today, that percentage is down to about three-quarters.

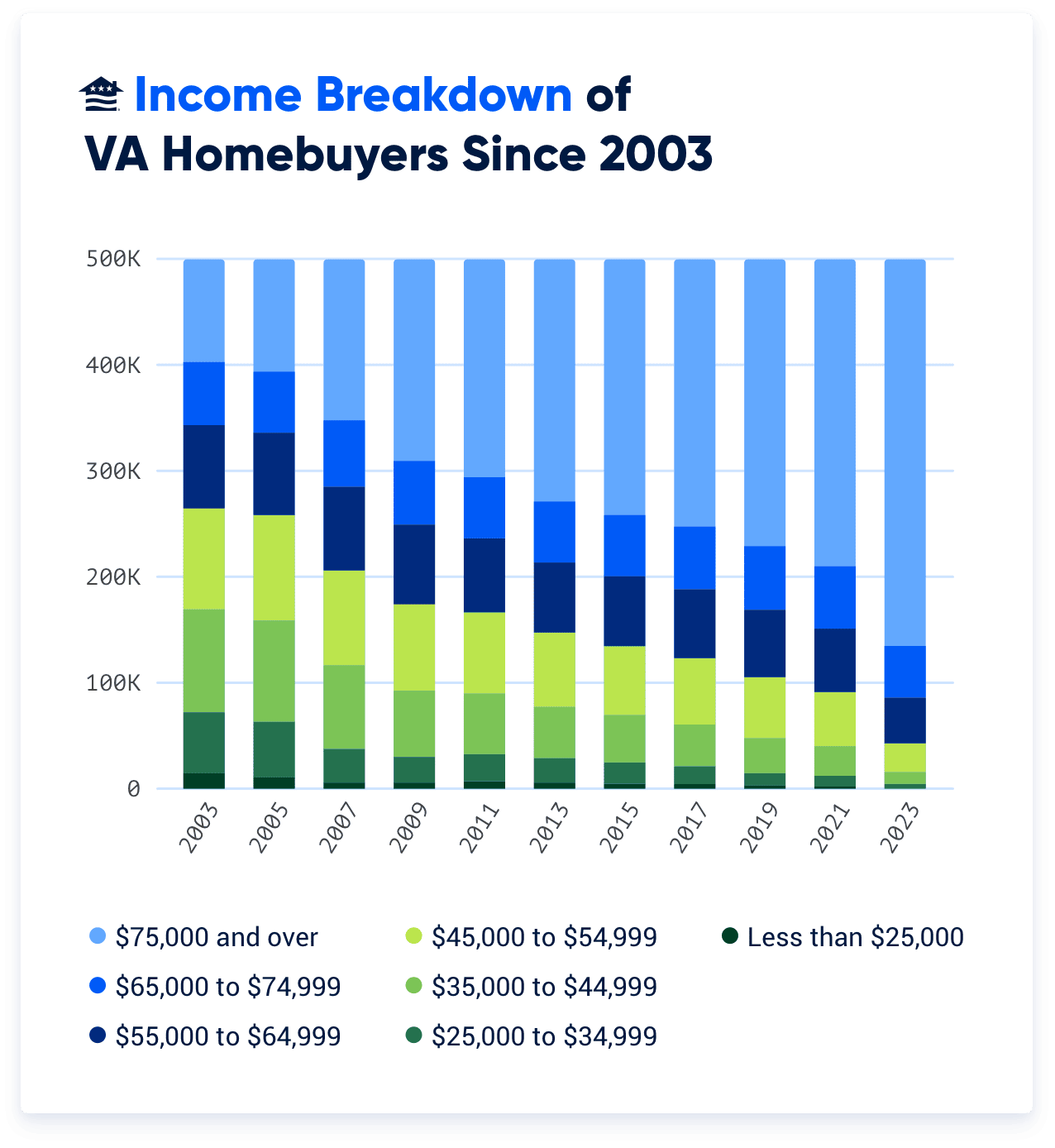

Shift to Higher-Income Borrowers

The income makeup of VA borrowers looks considerably different today than it did two decades ago, in the wake of shifting home prices, wages and inflation.

Veterans who make $75,000 or more accounted for about 1-in-5 VA loans in 2003. Last year, nearly three-quarters of VA loans went to this group.

Rising interest rates and home prices have exacerbated the trend in the last couple years. The 9-point jump in lending to this highest-income group from Fiscal Year 2022 to Fiscal Year 2023 is the biggest year-over-year increase of the last two decades.

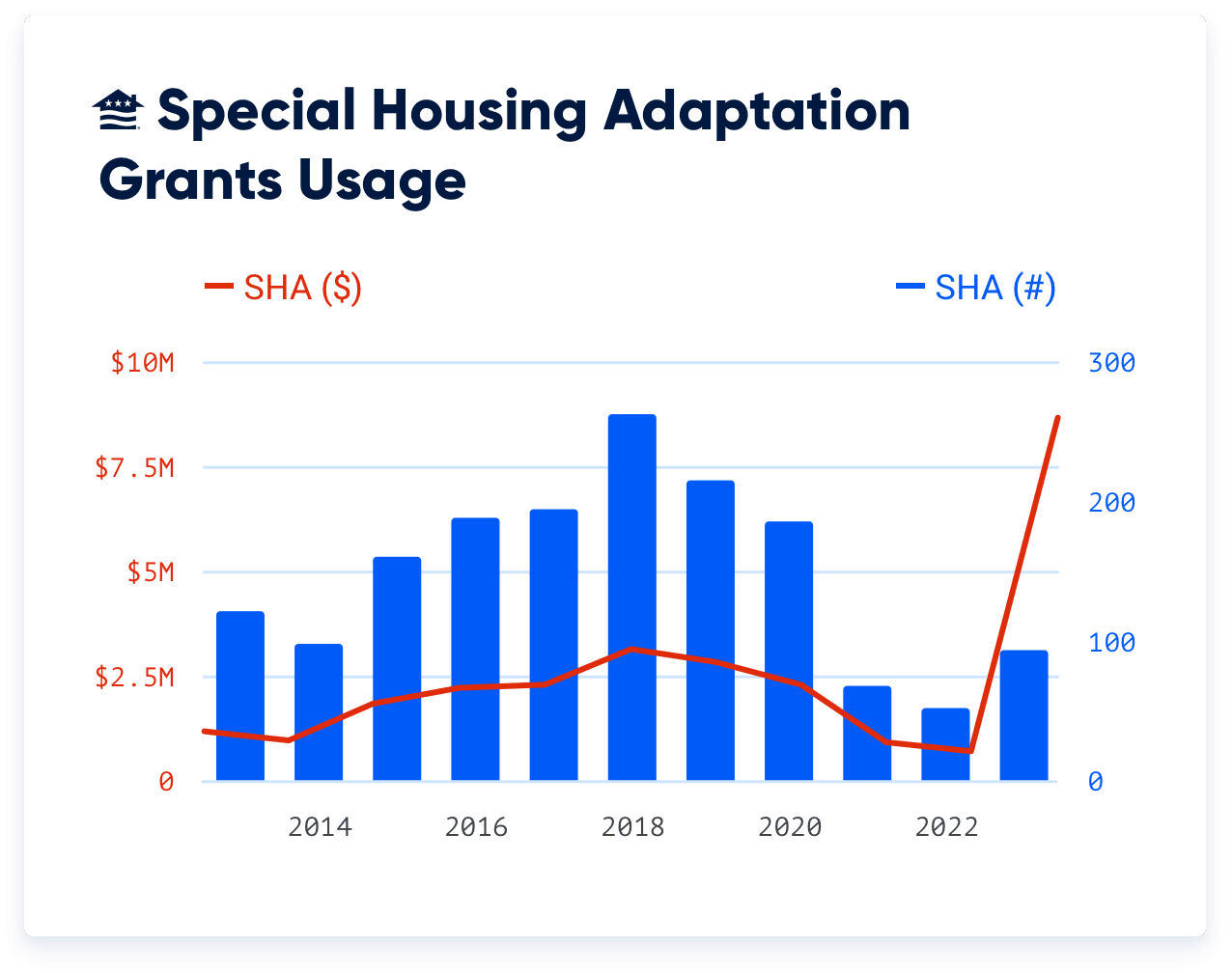

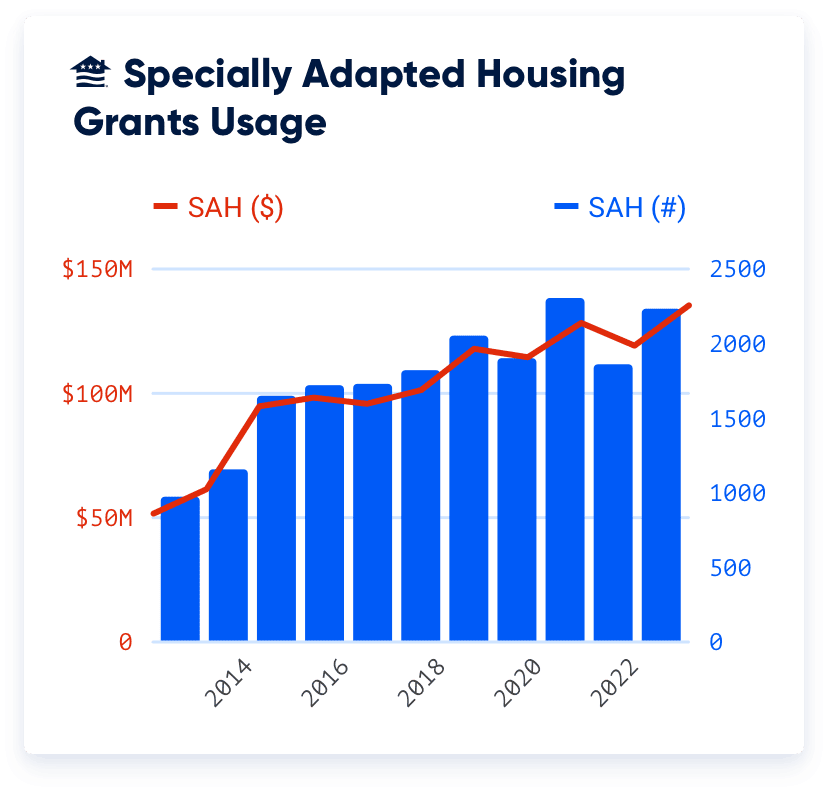

$1+ Billion in Housing Adaptation Grants

The VA offers a couple grant programs to aid Veterans with permanent service-related disabilities in creating or modifying their homes to suit their needs.

The Specially Adapted Housing (SAH) and the Special Housing Adaptation (SHA) grants have helped thousands of Veterans and military families over the last two decades alone. SAH grants come with a higher dollar amount, while SHA grants are available to a wider group of Veterans with disabilities.

Eligible Veterans can use SAH or SHA grant money up to six times over their lifetime.

Here’s a look at how these grants have been utilized over the past 20 years:

Helping Close the Homeownership Gap

Military service and the VA loan program are helping narrow the homeownership gap for female Veterans and Veterans of color.

The VA loan’s cornerstone benefits – no down payment, flexible credit underwriting and lower interest rates – have expanded access to homeownership for generations.

Female Veterans and Veterans of color all have higher homeownership rates than their civilian counterparts, according to a Veterans United analysis of Census and VA lending data.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.