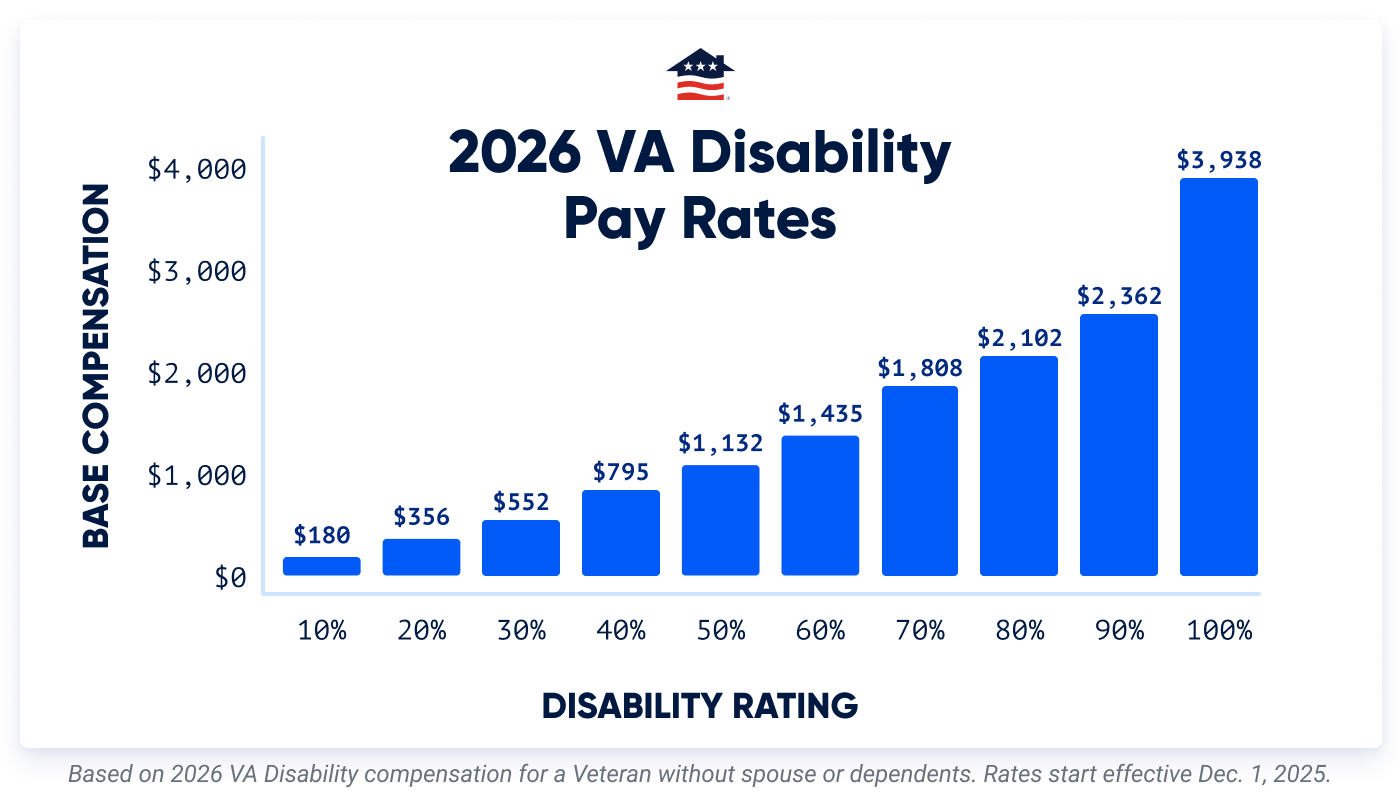

VA disability pay for 2026 increased by 2.8%, and new rates took effect on December 1, 2025.

Below are the 2026 VA disability pay charts, along with a VA disability payment calculator to help you determine your disability compensation quickly.

Calculate Your VA Disability

Use our VA disability calculator to determine your annual and monthly pay. The VA disability rate refers to your assigned percentage, while VA disability pay is the monthly tax-free amount you receive based on that rate.

If you’re unsure what your VA disability rating might be, our calculator can also help you estimate your combined VA disability percentage based on your service-connected conditions. Simply select the area of each disability and the corresponding disability percentage to instantly estimate your combined disability rating.

2026 VA Disability Pay Charts

On October 24, 2025, the Social Security Administration (SSA) announced a 2.8% Cost of Living Adjustment (COLA). The VA confirmed this adjustment to disability pay rates on December 1, 2025, and these rates are effective through December 2026.

Here are the new VA disability pay rates:

2026 Pay Rates for 10% – 20% Disability Rating

| Disability Rating | Monthly Pay |

|---|---|

| 10% | $180.42 |

| 20% | $356.66 |

Note: Veterans with a 10% to 20% rating won't receive additional compensation for a dependent spouse, child or parent.

Calculating Added Amounts for Aid and Attendance and Additional Children

Veterans with a 30% or greater disability rating may receive additional compensation for dependent children or a spouse receiving Aid and Attendance benefits. To calculate additional compensation, use the respective "additional" rows at the end of each table.

For example, a Veteran with a 30% disability rating, a spouse and three children under 18 would receive $730.47 each month. Here’s how that breaks down:

- $666.47 for Veteran with spouse and one child

- $32.00 for additional child #2

- $32.00 for additional child #3

Total VA Disability Pay: $666.47 + $32.00 + $32.00 = $730.47

2026 Pay Rates for 30% – 60% Disability Rating

| Dependent Status | 30% Disability Rating | 40% Disability Rating | 50% Disability Rating | 60% Disability Rating |

|---|---|---|---|---|

| Veteran (No Dependents) | $552.47 | $795.84 | $1,132.90 | $1,435.02 |

| Veteran with Spouse (No Dependents) | $617.47 | $882.84 | $1,241.90 | $1,566.02 |

| Veteran with Spouse and 1 Child | $666.47 | $947.84 | $1,322.90 | $1,663.02 |

| Veteran with 1 Child | $596.47 | $853.84 | $1,205.90 | $1,523.02 |

| Veteran with 1 Parent | $604.47 | $865.84 | $1,220.90 | $1,540.02 |

| Veteran with 2 Parents | $656.47 | $935.84 | $1,308.90 | $1,645.02 |

| Veteran with 1 Parent and 1 Child | $648.47 | $923.84 | $1,293.90 | $1,628.02 |

| Veteran with 2 Parents and 1 Child | $700.47 | $993.84 | $1,381.90 | $1,733.02 |

| Veteran with Spouse and 1 Parent | $669.47 | $952.84 | $1,329.90 | $1,671.02 |

| Veteran with Spouse and 2 Parents | $721.47 | $1,022.84 | $1,417.90 | $1,776.02 |

| Veteran with Spouse, 1 Parent and 1 Child | $718.47 | $1,017.84 | $1,410.90 | $1,768.02 |

| Veteran with Spouse, 2 Parents and 1 Child | $770.47 | $1,087.84 | $1,498.90 | $1,873.02 |

| Each Additional Child Under 18 | $32.00 | $43.00 | $54.00 | $65.00 |

| Each Additional Schoolchild Over Age 18 in School | $105.00 | $140.00 | $176.00 | $211.00 |

| Additional for Spouse on Aid and Attendance | $61.00 | $81.00 | $101.00 | $121.00 |

2026 Pay Rates for 70% – 100% Disability Rating

| Dependent Status | 70% Disability Rating | 80% Disability Rating | 90% Disability Rating | 100% Disability Rating |

|---|---|---|---|---|

| Veteran (No Dependents) | $1,808.45 | $2,102.15 | $2,362.30 | $3,938.58 |

| Veteran with Spouse (No Dependents) | $1,961.45 | $2,277.15 | $2,559.30 | $4,158.17 |

| Veteran with Spouse and 1 Child | $2,074.45 | $2,406.15 | $2,704.30 | $4,318.99 |

| Veteran with 1 Child | $1,910.45 | $2,219.15 | $2,494.30 | $4,085.43 |

| Veteran with 1 Parent | $1,931.45 | $2,242.15 | $2,520.30 | $4,114.82 |

| Veteran with 2 Parents | $2,054.45 | $2,382.15 | $2,678.30 | $4,291.06 |

| Veteran with 1 Parent and 1 Child | $2,033.45 | $2,359.15 | $2,652.30 | $4,261.67 |

| Veteran with 2 Parents and 1 Child | $2,156.45 | $2,499.15 | $2,810.30 | $4,437.91 |

| Veteran with Spouse and 1 Parent | $2,084.45 | $2,417.15 | $2,717.30 | $4,334.41 |

| Veteran with Spouse and 2 Parents | $2,207.45 | $2,557.15 | $2,875.30 | $4,510.65 |

| Veteran with Spouse, 1 Parent and 1 Child | $2,197.45 | $2,546.15 | $2,862.30 | $4,495.23 |

| Veteran with Spouse, 2 Parents and 1 Child | $2,320.45 | $2,686.15 | $3,020.30 | $4,671.47 |

| Each Additional Child Under 18 | $76.00 | $87.00 | $98.00 | $109.11 |

| Each Additional Schoolchild Over Age 18 in School | $246.00 | $281.00 | $317.00 | $352.45 |

| Additional for Spouse on Aid and Attendance | $141.00 | $161.00 | $181.00 | $201.41 |

Historic VA Disability Pay Increases

This year’s 2.8% increase helps ensure that Veterans’ benefits continue to keep pace with everyday expenses. See the table below to compare these changes from 1976 to today.

How VA Disability Pay Works

Understanding how VA disability pay is calculated can help you make the most of the benefits you’ve earned. Below is a general breakdown of how this benefit works.

Am I Eligible for VA Disability Compensation?

Veterans living with service-connected physical or mental conditions may be eligible for monthly VA disability compensation and benefits.

You may qualify for VA disability compensation if you meet one of these conditions:

- You became sick or injured while serving in the military

- You had an existing condition that military service worsened

- A disability appeared after leaving military service but is connected to your time served

Helpful Tip: Get physical and mental conditions documented by a doctor while you're still in service. It’s easier to prove service connection later.

The VA will need evidence that your sicknesses or illnesses are connected to your service to support your disability claim when applying, which we discuss later on.

How Do I Determine My VA Disability Compensation?

To determine your disability compensation, you need to file a claim with VA. The VA rates your disability by severity after reviewing every piece of evidence in your claim.

You may only receive compensation for a single diagnostic code per condition, even if that condition satisfies more than one diagnostic code. However, those with more than one condition may receive additional compensation based on the combined rating system.

You may receive additional compensation if:

- You have very severe disabilities or loss of limb(s)

- You have a spouse, children or dependent parents

- You have a seriously disabled spouse

Note: If you have more than one child or your spouse receives Aid and Attendance benefits (signified by A&A in the table cell below), be sure to include the figures from the "Add" row.

Does My Ability to Work Affect My VA Disability Rating or Pay?

Yes, your ability to work plays a role in how the VA determines your disability rating — and in some cases, it can qualify you for additional benefits.

If your service-connected conditions make it impossible to maintain steady employment, you may be eligible for Total Disability based on Individual Unemployability (TDIU). This benefit allows the VA to pay you at the 100% disability rate, even if your combined rating is less than 100%.

It’s important to know that a 100% VA rating doesn’t automatically mean you can’t work. If your rating is based solely on the severity of your condition, you can still earn income and receive full compensation.

How Do I Apply for VA Disability Benefits?

The Department of Veterans Affairs recommends eligible Veterans apply for disability compensation benefits online through the VA’s portal. However, Veterans may also apply by mail with VA Form 21-526EZ, in person at your regional benefits office or with help from a trained professional.

In any case, you will need access to your DD214 (or equivalent discharge or separation papers), the medical evidence of the disability and dependency records (marriage license and children's birth certificates).

If you have yet to separate from service, you may still apply using the Benefits Delivery at Discharge (BDD) program. To be eligible for the BDD, you must:

- Be on full-time active duty (including members of the National Guard, Reserve, or Coast Guard),

- Have a known separation date and

- Your separation date is in the next 90 to 180 days

If you have less than 90 days until separation, you may still file a fully developed or standard claim.

Types of VA Disability Compensation Claims

Generally, there are three methods to apply for disability compensation, each with different timelines to receive benefits.

Decision Ready Claims Program

The fastest method of applying is through the VA's Decision Ready Claims (DRC) program. This program requires you to work with an accredited Veterans Service Organization (VSO) but generally processes claims in 30 days or less.

As of now, the only types of claims the DRC program processes are:

- Conditions that began during, or caused by, service (Direct Service Connection Claim)

- Conditions that are believed to be caused by military service with no direct evidence (Presumptive Service Connection Claim)

- Conditions caused or made worse by a service-connected disability (Secondary Service Connection Claim)

- A current disability claim that is medically proven to have gotten worse (Increased Disability Claim)

- Claims for eligible surviving spouses (Dependency and Indemnity Compensation Claim)

- Claims for service members with less than 90 days before separating from the military (Pre-Discharge Claim)

There are additional restrictions for filing under the DRC program. Those applying can consult their VSO to determine if the DRC program is right for them.

Fully Developed Disability Claims

The next fastest option is the Fully Developed Disability Claims (FDDC) program.

The primary difference between the FDDC program and filing a standard claim is the Veteran must provide all evidence upfront and certify there's no additional evidence needed to make a claim decision.

At a minimum, the Veteran should provide:

- All military personnel records on the condition,

- All service treatment records on the condition,

- All private (non-VA) medical records on the condition and

- All VA health records or supplementary information about related VA health records that the VA can request on your behalf

If the VA requires additional information, the claim typically gets removed from the FDDC program and is processed as a standard claim.

Standard VA Disability Claims

With standard VA disability claims, the VA gathers evidence and compiles all supporting documents.

If the VA is unable to obtain a needed document, they may require your help. When help is required, it typically applies to documents not held by a federal agency, such as private medical records, employer information and documents from state or local governments.

As with all claims programs, be prepared to provide your DD214 (or other separation documents), service treatment records, VA medical records and private medical records about your claim. Those needing help applying for their VA disability claim may also work with an accredited attorney, claims agent or Veterans Service Officer (VSO).

What is the Average Wait Time for a VA Disability Claim?

As of November 2025, the average time to complete VA disability-related claims is around 85 days, according to Veterans Benefits Administration (VBA) reports. If you opted for the Fully Developed Disability Claim, you could receive your results within 30 days.

While processing times can vary, understanding the average wait time can help you set clear expectations and stay prepared throughout the process. The time it takes from claim submission to VA rating can also vary from Veteran to Veteran.

Some common reasons for delays include the workload at your VBA regional office, the type of claim, how many disabilities are claimed, the complexity of the disabilities and when the VA collects the evidence supporting your claim.

Complicated conditions or multiple claims require more review time. The VA might also schedule Compensation and Pension (C&P) exams or request more evidence, which adds to the wait.

How to Speed Up Your VA Disability Claim

To help your VA disability claim move faster, submit all required forms and supporting evidence with your initial application. Providing complete documentation upfront helps the VA make a decision sooner and reduces the risk of processing delays.

All relevant medical and service records that show when and how your condition began should be submitted. This includes VA and private medical records. If possible, ask your doctor to write a nexus letter that clearly links your condition to your military service. Establishing care at a VA health facility can also support your claim.

Some Veterans may qualify for faster review through a Priority Processing Request. To apply, submit VA Form 20-10207. However, eligibility is limited to specific situations, such as terminal illness, extreme financial hardship or being age 85 or older.

While the process can take time, strong evidence and proactive preparation can improve your chances of a quicker decision. Stay organized, follow up on your paperwork and seek help when needed.

Combined Rating System for Veterans With Multiple Disabilities

If you have more than one service-connected disability, the VA uses a combined rating system to determine your total compensation.

To use the combined rating system, arrange your disabilities in order from highest to lowest percentage. Then, use the table below to find the intersection of the two ratings.

The result is a combined percentage, which the VA rounds to the nearest 10%.

If you have more than two disabilities, start by combining the first two ratings (without rounding), then repeat the process with the third. Once you’ve calculated the final combined value, round it to the nearest 10%.

For example, if one disability rating is 40% and another is 20%, the combined rating is 52%. That figure gets rounded to the nearest 10%, making the final combined disability rating 50%.

For a three-disability example, if one disability is rated at 60%, another at 30% and a third at 20%, start by combining the 60% and 30% ratings. Using the table below, that gives you a combined value of 72%. Next, take that 72% and find the intersect with the third rating of 20%. The final combined rating comes out to an even 80% rating, so no rounding is needed.

| 10 | 20 | 30 | 40 | 50 | 60 | 70 | 80 | 90 | |

|---|---|---|---|---|---|---|---|---|---|

| 19 | 27 | 35 | 43 | 51 | 60 | 68 | 76 | 84 | 92 |

| 20 | 28 | 36 | 44 | 52 | 60 | 68 | 76 | 84 | 92 |

| 21 | 29 | 37 | 45 | 53 | 61 | 68 | 76 | 84 | 92 |

| 22 | 30 | 38 | 45 | 53 | 61 | 69 | 77 | 84 | 92 |

| 23 | 31 | 38 | 46 | 54 | 62 | 69 | 77 | 85 | 92 |

| 24 | 32 | 39 | 47 | 54 | 62 | 70 | 77 | 85 | 92 |

| 25 | 33 | 40 | 48 | 55 | 63 | 70 | 78 | 85 | 93 |

| 26 | 33 | 41 | 48 | 56 | 63 | 70 | 78 | 85 | 93 |

| 27 | 34 | 42 | 49 | 56 | 64 | 71 | 78 | 85 | 93 |

| 28 | 35 | 42 | 50 | 57 | 64 | 71 | 78 | 86 | 93 |

| 29 | 36 | 43 | 50 | 57 | 65 | 72 | 79 | 86 | 93 |

| 30 | 37 | 44 | 51 | 58 | 65 | 72 | 79 | 86 | 93 |

| 31 | 38 | 45 | 52 | 59 | 66 | 72 | 79 | 86 | 93 |

| 32 | 39 | 46 | 52 | 59 | 66 | 73 | 80 | 86 | 93 |

| 33 | 40 | 46 | 53 | 60 | 67 | 73 | 80 | 87 | 93 |

| 34 | 41 | 47 | 54 | 60 | 67 | 74 | 80 | 87 | 93 |

| 35 | 42 | 48 | 55 | 61 | 68 | 74 | 81 | 87 | 94 |

| 36 | 42 | 49 | 55 | 62 | 68 | 74 | 81 | 87 | 94 |

| 37 | 43 | 50 | 56 | 62 | 69 | 75 | 81 | 87 | 94 |

| 38 | 44 | 50 | 57 | 63 | 69 | 75 | 81 | 88 | 94 |

| 39 | 45 | 51 | 57 | 63 | 70 | 76 | 82 | 88 | 94 |

| 40 | 46 | 52 | 58 | 64 | 70 | 76 | 82 | 88 | 94 |

| 41 | 47 | 53 | 59 | 65 | 71 | 76 | 82 | 88 | 94 |

| 42 | 48 | 54 | 59 | 65 | 71 | 77 | 83 | 88 | 94 |

| 43 | 49 | 54 | 60 | 66 | 72 | 77 | 83 | 89 | 94 |

| 44 | 50 | 55 | 61 | 66 | 72 | 78 | 83 | 89 | 94 |

| 45 | 51 | 56 | 62 | 67 | 73 | 78 | 84 | 89 | 95 |

| 46 | 51 | 57 | 62 | 68 | 73 | 78 | 84 | 89 | 95 |

| 47 | 52 | 58 | 63 | 68 | 74 | 79 | 84 | 89 | 95 |

| 48 | 53 | 58 | 64 | 69 | 74 | 79 | 84 | 90 | 95 |

| 49 | 54 | 59 | 64 | 69 | 75 | 80 | 85 | 90 | 95 |

| 50 | 55 | 60 | 65 | 70 | 75 | 80 | 85 | 90 | 95 |

| 51 | 56 | 61 | 66 | 71 | 76 | 80 | 85 | 90 | 95 |

| 52 | 57 | 62 | 66 | 71 | 76 | 81 | 86 | 90 | 95 |

| 53 | 58 | 62 | 67 | 72 | 77 | 81 | 86 | 91 | 95 |

| 54 | 59 | 63 | 68 | 72 | 77 | 82 | 86 | 91 | 95 |

| 55 | 60 | 64 | 69 | 73 | 78 | 82 | 87 | 91 | 96 |

| 56 | 60 | 65 | 69 | 74 | 78 | 82 | 87 | 91 | 96 |

| 57 | 61 | 66 | 70 | 74 | 79 | 83 | 87 | 91 | 96 |

| 58 | 62 | 66 | 71 | 75 | 79 | 83 | 87 | 92 | 96 |

| 59 | 63 | 67 | 71 | 75 | 80 | 84 | 88 | 92 | 96 |

| 60 | 64 | 68 | 72 | 76 | 80 | 84 | 88 | 92 | 96 |

| 61 | 65 | 69 | 73 | 77 | 81 | 84 | 88 | 92 | 96 |

| 62 | 66 | 70 | 73 | 77 | 81 | 85 | 89 | 92 | 96 |

| 63 | 67 | 70 | 74 | 78 | 82 | 85 | 89 | 93 | 96 |

| 64 | 68 | 71 | 75 | 78 | 82 | 86 | 89 | 93 | 96 |

| 65 | 69 | 72 | 76 | 79 | 83 | 86 | 90 | 93 | 97 |

| 66 | 69 | 73 | 76 | 80 | 83 | 86 | 90 | 93 | 97 |

| 67 | 70 | 74 | 77 | 80 | 84 | 87 | 90 | 93 | 97 |

| 68 | 71 | 74 | 78 | 81 | 84 | 87 | 90 | 94 | 97 |

| 69 | 72 | 75 | 78 | 81 | 85 | 88 | 91 | 94 | 97 |

| 70 | 73 | 76 | 79 | 82 | 85 | 88 | 91 | 94 | 97 |

| 71 | 74 | 77 | 80 | 83 | 86 | 88 | 91 | 94 | 97 |

| 72 | 75 | 78 | 80 | 83 | 86 | 89 | 92 | 94 | 97 |

| 73 | 76 | 78 | 81 | 84 | 87 | 89 | 92 | 95 | 97 |

| 74 | 77 | 79 | 82 | 84 | 87 | 90 | 92 | 95 | 97 |

| 75 | 78 | 80 | 83 | 85 | 88 | 90 | 93 | 95 | 98 |

| 76 | 78 | 81 | 83 | 86 | 88 | 90 | 93 | 95 | 98 |

| 77 | 79 | 82 | 84 | 86 | 89 | 91 | 93 | 95 | 98 |

| 78 | 80 | 82 | 85 | 87 | 89 | 91 | 93 | 96 | 98 |

| 79 | 81 | 83 | 85 | 87 | 90 | 92 | 94 | 96 | 98 |

| 80 | 82 | 84 | 86 | 88 | 90 | 92 | 94 | 96 | 98 |

| 81 | 83 | 85 | 87 | 89 | 91 | 92 | 94 | 96 | 98 |

| 82 | 84 | 86 | 87 | 89 | 91 | 93 | 95 | 96 | 98 |

| 83 | 85 | 86 | 88 | 90 | 92 | 93 | 95 | 97 | 98 |

| 84 | 86 | 87 | 89 | 90 | 92 | 94 | 95 | 97 | 98 |

| 85 | 87 | 88 | 90 | 91 | 93 | 94 | 96 | 97 | 99 |

| 86 | 87 | 89 | 90 | 92 | 93 | 94 | 96 | 97 | 99 |

| 87 | 88 | 90 | 91 | 92 | 94 | 95 | 96 | 97 | 99 |

| 88 | 89 | 90 | 92 | 93 | 94 | 95 | 96 | 98 | 99 |

| 89 | 90 | 91 | 92 | 93 | 95 | 96 | 97 | 98 | 99 |

| 90 | 91 | 92 | 93 | 94 | 95 | 96 | 97 | 98 | 99 |

| 91 | 92 | 93 | 94 | 95 | 96 | 96 | 97 | 98 | 99 |

| 92 | 93 | 94 | 94 | 95 | 96 | 97 | 98 | 98 | 99 |

| 93 | 94 | 94 | 95 | 96 | 97 | 97 | 98 | 99 | 99 |

| 94 | 95 | 95 | 96 | 96 | 97 | 98 | 98 | 99 | 99 |

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Dec 2, 2025

Written ByPam Swan

Reviewed ByTara Dometrorch

Updated official VA disability rates for 2025.

Oct 24, 2025

Written ByPam Swan

Reviewed ByTara Dometrorch

Updated for projected VA disability rates for 2026, according to the Social Security Administration's announced 2.8% Cost of Living Adjustment (COLA). All tables, charts, and calculators were updated and reviewed for accuracy.

Jun 2, 2025

Written ByPam Swan

Reviewed ByTara Dometrorch

Major updates to article and calculator. Content reviewed and fact checked by team lead underwriter Tara Dometrorch.

Dec 2, 2024

Written ByPam Swan

Updated VA disability rates for 2025

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

Military Age Restrictions: How Old is Too Old to Serve?In general, the Defense Department restricts enlistment to those 35 and younger. Prior enlisted service members can subtract their previous years of service from their age in order to extend eligibility.

Military Age Restrictions: How Old is Too Old to Serve?In general, the Defense Department restricts enlistment to those 35 and younger. Prior enlisted service members can subtract their previous years of service from their age in order to extend eligibility. -

What Deployed Troops Really Want in Their Military Care PackagesFinding the right items to send overseas can be a challenge. We've included all the items service members really want in their military care packages.

What Deployed Troops Really Want in Their Military Care PackagesFinding the right items to send overseas can be a challenge. We've included all the items service members really want in their military care packages.