When buyers begin exploring VA home loan options, terms like “VA appraisal” and “professional home inspection” can understandably become muddled.

While a VA appraisal and professional inspection vary, each holds crucial benefits for military buyers. We’re here to make sure you understand the function and objectives of both before buying a home with your VA loan benefit.

Is a VA Appraisal the Same as a Home Inspection?

No, a VA appraisal is not the same as a professional home inspection. VA appraisals and home inspections are both used to evaluate a property, but they serve different purposes and are conducted for different reasons.

A VA appraisal is required to purchase a home with a VA loan, and its primary purposes are to assess a property's current market value and to ensure the property is compliant with VA Minimum Property Requirements. Homebuyers are typically responsible for paying the VA appraisal fee upfront.

A home inspection, on the other hand, is not required to purchase a home but is strongly recommended. It is a thorough and more detailed review of the home's physical condition and all of its systems including the home’s structure, roof, plumbing, electrical, HVAC and more. The cost ranges from $300 to $500 but can vary based on the size of the home and location.

VA Appraisal vs. Home Inspection

VA appraisals and home inspections are not the same, but how exactly do they differ?

One of the main differences between a VA appraisal and a home inspection is that a home inspection is more comprehensive and assesses the overall condition of the property. This assessment can help VA homebuyers make informed decisions and negotiate repairs or price adjustments before finalizing the home purchase.

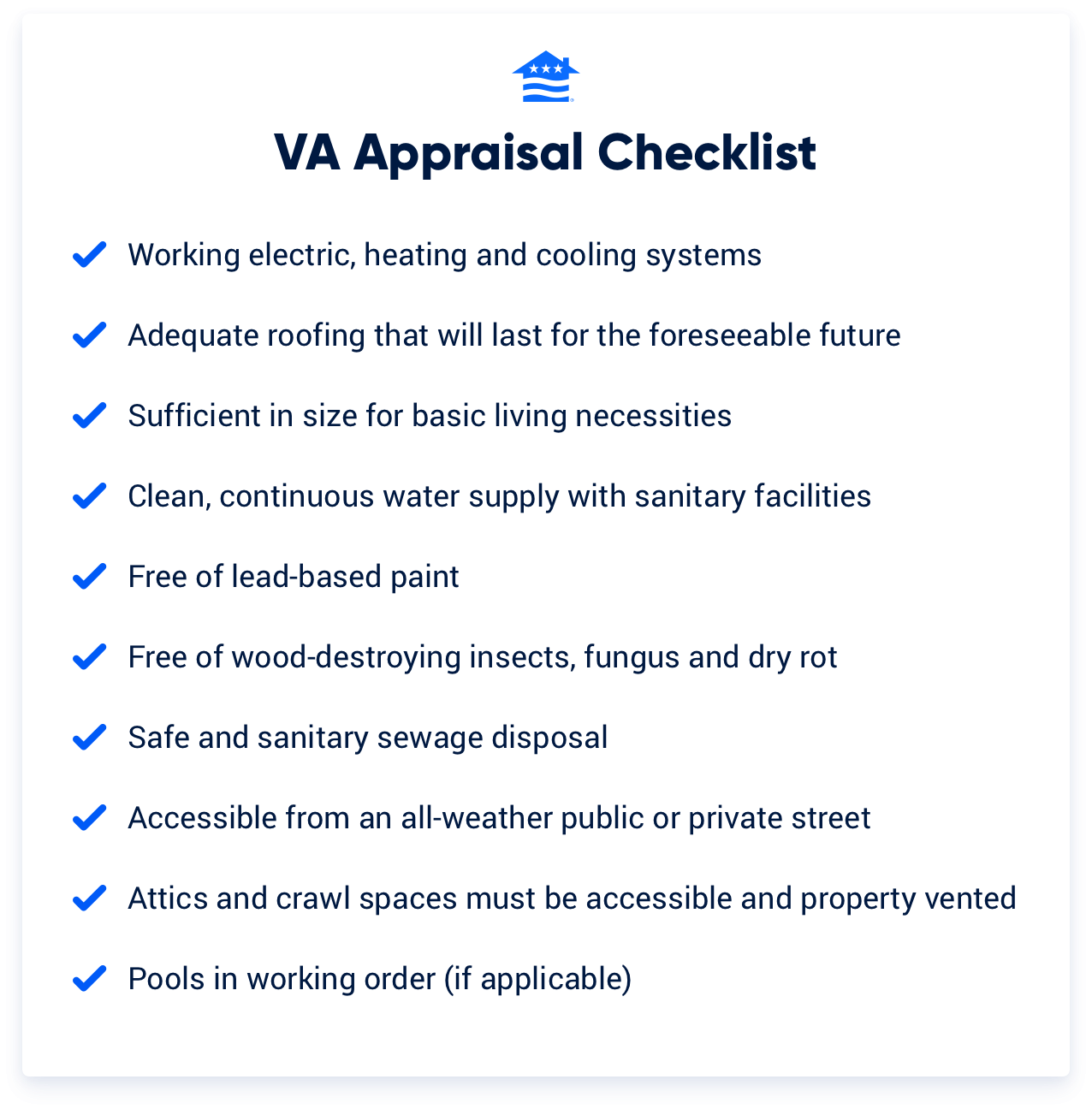

In relation to a home inspection, the VA appraisal has a very narrow focus. The VA appraiser assigns a fair market value to a home and compares the property against the VA’s MPR checklist.

But if an item isn’t on that MPR checklist, there’s a fair chance it won’t be mentioned on the VA appraisal report. It’s not an appraiser’s job to do a thorough evaluation of a home’s every nook and cranny.

That’s exactly the job of a good home inspector.

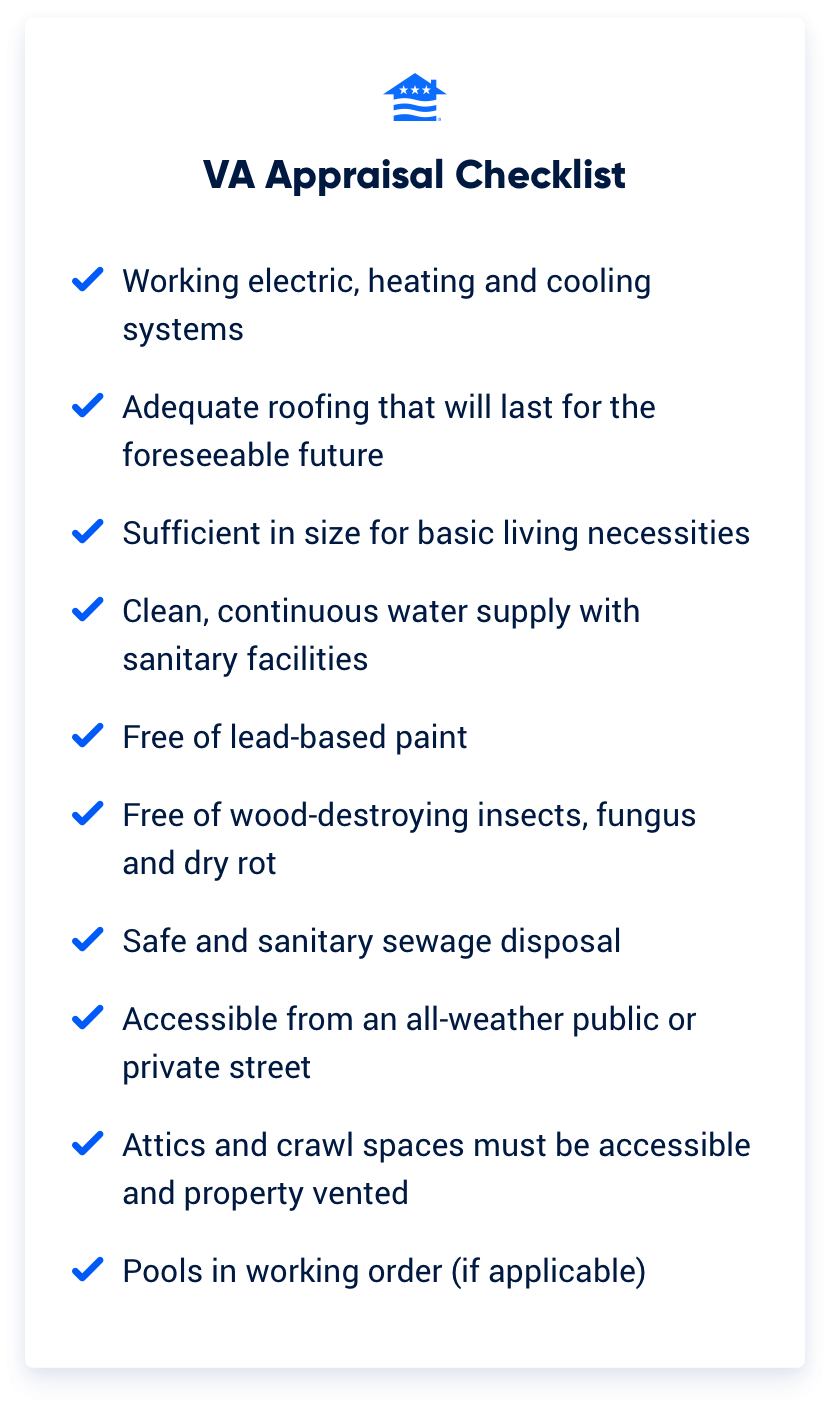

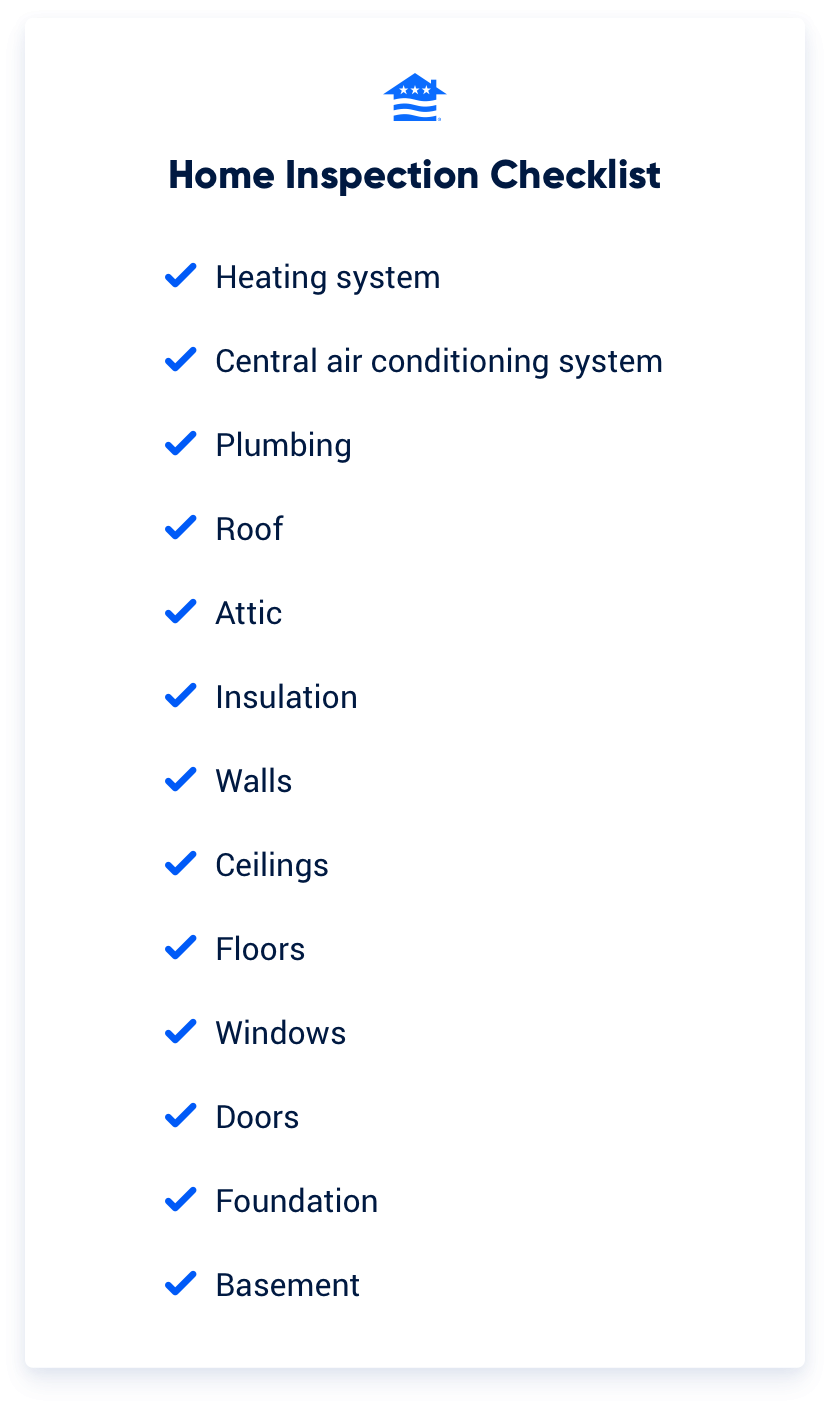

VA Appraisal Checklist vs. Home Inspection Checklist

Want to know what’s covered during a VA loan appraisal and home inspection? Take a glance at the checklists below to see how they compare.

Home inspectors will check your air conditioner, electric panels and garage door openers. Any problems or symptoms of a problem will be carefully described and remedies will likely be suggested.

In summary, a VA appraisal determines the property's value and makes sure it meets basic livability standards, while a home inspection focuses on its condition and potential issues.

While there's some overlap, a VA appraisal isn't a substitute for a home inspection. VA appraisers are not home inspectors. They’re each useful tools that provide different levels of information about the property.

Should I Get a Home Inspection With a VA Loan?

While a VA appraisal is a mandatory part of securing a VA loan, the appraisal process isn't designed to give a detailed analysis of every aspect of the home's condition.

A home inspection could provide a detailed analysis of the home’s current condition and uncover potential issues the appraisal missed. Home inspection reports can be a great resource for buyers planning future costs and when negotiating with the seller regarding repairs.

While a home inspection comes with an upfront cost, it could potentially save thousands of dollars in the long run by uncovering issues that could lead to expensive repairs down the line. It's a wise decision to consider a home inspection as an essential part of the homebuying process even with a VA loan.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jul 1, 2025

Written BySamantha Reeves

Added video, "VA Home Loan Appraisal vs. Home Inspection"

Related Posts

-

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no down payment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence.

5 Most Common VA Loan Myths BustedVA loan myths confuse and deter many VA loan borrowers. Here we debunk 5 of the most common VA loan myths so that you can borrow with confidence.