- A VA Energy Efficient Mortgage may allow eligible Veterans to finance up to $6,000 in approved energy-saving home improvements.

- Qualifying upgrades include permanent changes like solar panels, insulation and weatherproofing.

- EEMs can be used for home purchases or refinances, but documentation may be required based on upgrade costs.

Energy Efficient Mortgages (EEM) are an excellent option to pay for qualified improvements to increase a home’s energy efficiency and save money on utility bills. EEM homes can provide increased protection against heat, cold, pollution and moisture while also reducing your carbon footprint.

According to Rewiring America, approximately 42% of all average carbon emissions come from decisions made in the home. With a VA loan, you have the option to roll certain energy-efficient improvements into your financing.

What is a VA Energy Efficient Mortgage?

A VA Energy Efficient Mortgage, or EEM, is a loan program available to Veterans that helps finance qualified energy efficiency-related home improvements with a VA loan.

Types of VA Loan Energy Efficient Improvements

A VA EEM is a great way to finance improvements for your home, especially when used with other VA loan products like a streamline refinance.

There are several energy-efficient updates you can make with the VA EEM that include:

- Installing a solar water heater or insulating the current one

- Adding solar panels

- Weatherproofing additions such as caulk

- Modifying furnace efficiency

- Adding new insulation to walls, the ceiling, etc.

- Installing a storm door or windows

- Vapor barriers

- Clock thermostats to time heating and cooling

A quick note: While solar panels meet the qualify for a VA EEM, some systems may exceed the $6,000 cap. If you’re exploring solar panels, be sure to talk with your lender first.

Ineligible VA EEM Home Improvements

VA EEM improvements typically need to be permanent to the property. Window air conditioning units wouldn't be considered permanent since they are easily uninstallable, and adding central air conditioning to a home wouldn't likely increase a home's energy efficiency.

Ineligible updates can include:

- Energy Star-rated appliances (i.e., refrigerators, washing machines)

- A/C units

- Vinyl siding

- New roof or shingles

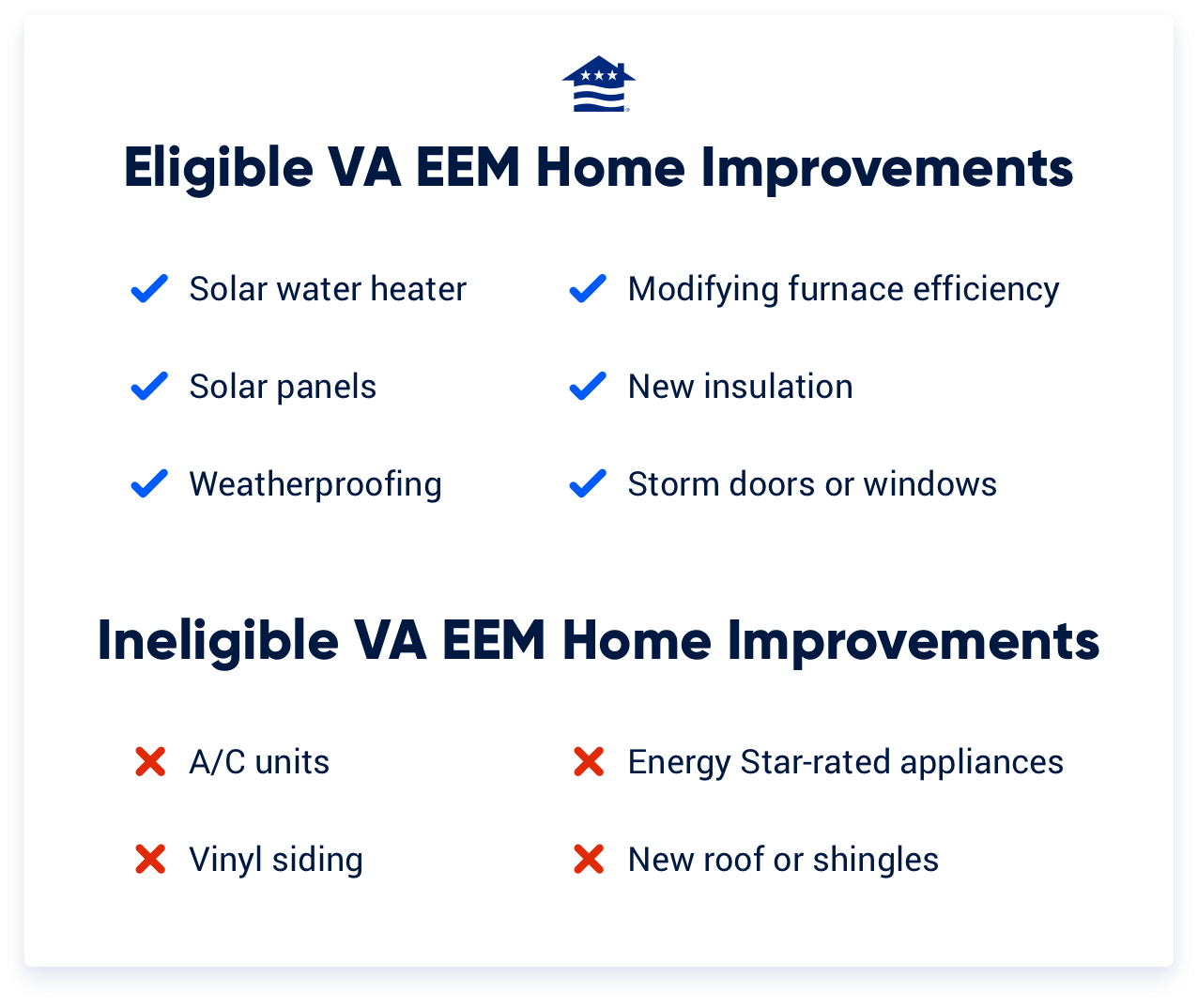

Here’s a quick visual breakdown of what’s typically allowed and what’s not:

Pros and Cons of a VA Energy Efficient Mortgage

Making energy-efficient updates has many benefits, especially with a VA loan. While these improvements may lower your utility bills over time, it's important to weigh them against the upfront costs and limitations of the program.

Pros:

- Improved comfort year-round

- Reduced noise and pollution

- Healthier living environment

- Potential increase in resale value

- Cuts in long-term utility costs

Cons:

- Borrowing more money to cover the cost of upgrades

- Some upfront costs, including contractor fees

- Spending limit of $6,000 (unless certain circumstances apply)

- It may take years to fully recoup costs

3 Cost Tiers for EEMs

There are three cost tiers of VA Energy Efficient Mortgages:

1. Improvements up to $3,000: This is the easiest tier to get approved. You will generally need to provide a copy of a contractor bid or quote, itemizing the costs and manufacturer information for each product.

2. Improvements totaling $3,001 – $6,000: In addition to the information required in the first tier, you'll also have to obtain an energy audit and/or a contractor’s bid showing a year's worth of utility cost averages for the home. These documents will be reviewed to determine if the proposed EEM improvements will significantly impact the utilities to be cost-effective.

3. Improvements with an Interest Rate Reduction Refinance Loan (IRRRL): Lenders need to certify that the homeowner can qualify for a higher payment if the cost of energy-efficient improvements causes the new monthly mortgage payment (PITI) to be 20% or higher than the payment on the loan being refinanced.

Veterans typically have six months after closing to complete the VA energy efficiency improvements. Small fixes can be made before closing. Otherwise, the lender may decide to open an escrow account for the improvement funding.

Am I Eligible for a VA Energy Efficient Mortgage?

If you’re eligible for a VA loan, you may also qualify for a VA Energy Efficient Mortgage. These loans are available for both home purchases and refinances, as long as the energy improvements meet guidelines.

VA appraisals include a section explaining the option to add energy-efficient upgrades to your loan. This section often recommends getting a Home Energy Rating System (HERS) report, which helps identify potential energy improvements. While not always mandatory, a HERS report is commonly required to qualify for a VA EEM, as it documents the expected energy savings.

What is a good HERS Index score?

The standard for new homes is a 100 HERS score, while a score of 130 is ideal for a previously occupied home. HERS reports document how efficiently a home is operating and potential improvements. The HERS index score ranges from 0 to 150. The lower the number, the more efficiently a home functions.

Factors for a HERS score that the VA EEM may affect include:

- Building enclosure (i.e., walls, ceiling, roof, foundation)

- Leakage testing

- Insulation levels

- Appliance and lighting performance

- HVAC efficiencies

- Ventilation systems

VA Energy Efficient Mortgage Uses

There are three basic approaches to using a VA EEM:

- You can use an EEM on an already energy-efficient home. The VA home loan allows qualified borrowers to finance up to $6,000 worth of upgrades if the home meets the HERS energy-efficient standards.

- You can use an EEM to buy an older home that needs energy improvements. Improvements like thermal windows and insulation can be applied, so the home meets HERS standards.

- If your current home needs energy improvement, a VA refinance with an EEM might make sense. Even if you have an outdated house that needs energy improvement, consider the benefits of refinancing under an EEM.

In the long run, a VA EEM can yield significant benefits and help reduce your carbon footprint. But every buyer's situation is different.

Does the VA Pay for Solar Panels?

Unfortunately, there is no disabled Veterans solar program. The VA does not pay for solar panels for Veterans directly. However, the VA Energy Efficient Mortgage is a great way to roll improvements into the cost of your home, like solar panels or solar heating and cooling systems. Just make sure you don’t exceed the cost limitations.

Finding the Right VA EEM Lender

Finding the best lender for a VA EEM is a similar process to finding the right one for a standard VA loan, but there are a few key differences to keep in mind.

Start by understanding the basic loan requirements, such as credit score and financial qualifications. For example, Veterans United typically looks for a minimum credit score of 620 for both standard VA loans and VA EEMs. However, not all lenders offer VA EEMs, so it's important to confirm early on whether a lender supports this type of financing.

Additionally, lenders that offer VA EEMs have different timelines and processes for handling steps like contractor bids and documentation for EEM-eligible upgrades. Make sure to ask questions about how energy improvements are evaluated and approved.

Before moving forward, be sure to get written estimates for the upgrades you plan. This will help you better understand the upfront costs and weigh them against the potential long-term savings.

Reach out to a Veterans United VA loan expert at 855-870-8845 to discuss your energy-efficient upgrades or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Dec 10, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Minimal content update, adding information about finding the right EEM lender with a VA loan. Article reviewed and fact checked by team lead underwriter Tara Dometrorch.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.